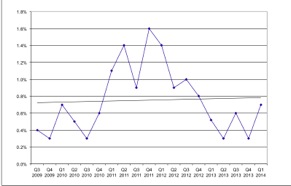

In this installment of “The Pulse,” TLG Research looks at the economic trends influencing fourth quarter pricing changes for various parts and service categories. Below are TLG’s thoughts on the matter.

“2013 was a mixed year. On one hand, the OEM vehicle business returned to levels not witnessed in a few years. The inflationary heat on copper, aluminum and other non-ferrous metals had subsided a bit in the fall. At the same time light trucks, the industry margin driver, roared back. In the end, it was an all-around winner for the OEMs.

The same was not true in the aftermarket and with installers. Repair order volume was basically flat in the shops. Financial results, in the total, were fairly flat for the auto parts makers as well. The bottom line was that aftermarket activity was lower while OEM took off. It would appear from this seat that the challenges of OEM capacity and other related issues trumped all for 2013.

On the broader front, pricing is pressured on a number of fronts, which include:

1. Continuing high unemployment, an all-time high with people not in the workforce and flat personal income

2. Individuals beginning to realize the out-of-pocket impact of higher premiums and higher deductibles tied to the PPACA

3. Lower pressure for now on most raw materials

4. Continuing pressure by customers on price increases as they meet their own margin challenges

Going forward into 2014 presents a very jumbled and tough scenario for forecasting. That said, it is the writer’s opinion that manufacturers do need to plan a pricing strategy now. Waiting until we find ourselves in a situation requiring large, frequent and unplanned increases is not a great strategy, but a recipe for disaster. We’ll expand on this in the next edition.

METHODOLOGY:

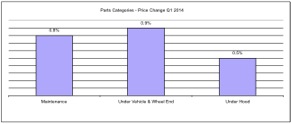

PARTS CATEGORY

1. Based on reported pricing of parts to service repair centers

2. Represents change of current quarter over the prior quarter

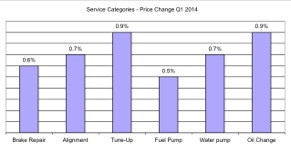

SERVICE CATEGORY

1. Represents total job repair order price to prior quarter

NOTES ABOUT PRICING CALCULATIONS:

The pricing is based on changes in the current quarter relative to the prior quarter. The data is collected from service repair centers with additional service repair center level pricing information provided by a number of sources. The “Parts Categories” includes only the parts. The “Service Categories” include both parts and labor and is based on the average reported. Pricing is collected in percent change, and is averaged across the U.S. Where needed the data is weighted in order to represent the entire market.

©2014 TLG Research, Inc. All rights reserved