In this installment of “The Pulse,” TLG Research looks at the economic trends influencing first quarter 2014 pricing changes for various parts and service categories. Below are TLG’s thoughts on the matter.

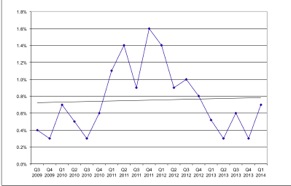

The price increases are once again running truer to form following a fairly flat fourth quarter in 2013. One wonders if this results from a desire to get a jump on the anticipated inflation down the road or due to a stronger third quarter and fourth quarter due primarily to weather.

The weather was an unusual factor this year with variations across the U.S., from bitter cold and snowy in the north to colder than normal in the south. To quote a friend in a nearby major Midwest city, “We have potholes large enough to swallow cars out here.”

Economically, 2013 ended about the way we expected and the same is true for 2014 to date. It all remains a mixed bag with little clear direction. It is, as doctors like to say, still time to plan for the worst and hope for the best. Unemployment remains high. Housing is all over the map. The GDP was not what one expects in a recovery. The list could continue. However, we offer a few recommendations relative to pricing for your consideration:

1. Manufacturers – keep moderate pressure on increases while maintaining cost controls to the extent possible to build the “war chest.”

2. Service Shops – push labor rates each quarter to get your rates up to cover the marginal players such as oil changes and position for whatever comes our way.

3. For all – the old axiom that there’s another golden rule … “the one with the most gold rules.” At times like this cash conservancy appears prudent while increasing margins.

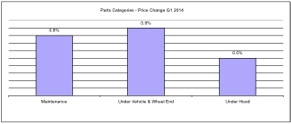

PARTS CATEGORY

1. Based on reported pricing of parts to service repair centers

2. Represents change of current quarter over the prior quarter

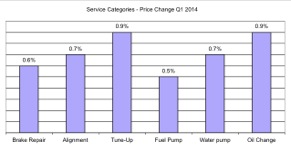

SERVICE CATEGORY

1. Represents total job repair order price to prior quarter

NOTES TO PRICING CALCULATIONS:

The pricing is based on changes in the current quarter relative to the prior quarter. The data is collected from service repair centers with additional service repair center level pricing information provided by a number of sources. The “Parts Categories” includes only the parts. The “Service Categories” include both parts and labor and is based on the average reported. Pricing is collected in percent change, and is averaged across the U.S. Where needed the data is weighted in order to represent the entire market.

©2014 TLG Research, Inc. All rights reserved.