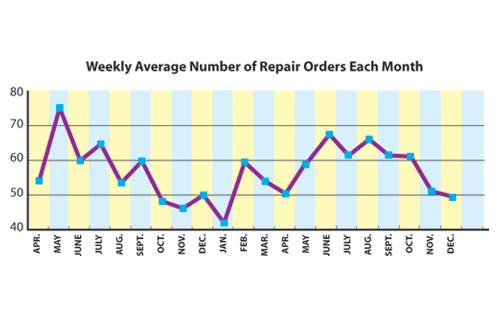

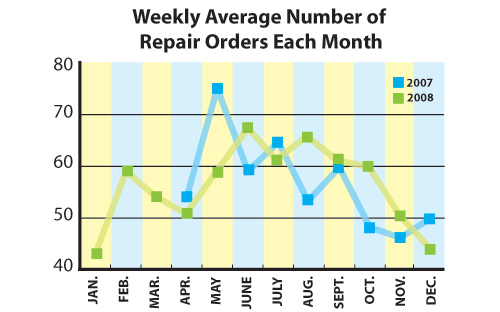

In this installment of “The Pulse,” we take a closer look at the state of business today at the repair shop level. In this series we will review rolling month-by-month data for the average number of weekly repair orders (ROs) written at General Repair Shops each month. Utilizing data from IMR Inc., we look at the numbers for April 2007 through December 2008.

Repair shops had a good run, in terms of average number of repair orders, with November up 8 percent compared to 2007, until this past December, when the average number of repairs dropped to 43.9. The decline from October up to this point can be attributed to seasonal slowness, however the current challenging economic conditions may also be a factor.

Comparing year to year, average repair orders are down as well – dropping from an average of 50 repair orders in December 2007, to 43.9 in December 2008.

For more information on IMR and its research capabilities, visit IMR at www.AutomotiveResearch.com or call Bill Thompson at 800-654-1079.