When it comes to the cost of auto insurance, mileage matters, and, to most, that’s no surprise. But many drivers may be shocked by how much their annual miles – and location – can cause their rates to rise.

When it comes to the cost of auto insurance, mileage matters, and, to most, that’s no surprise. But many drivers may be shocked by how much their annual miles – and location – can cause their rates to rise.

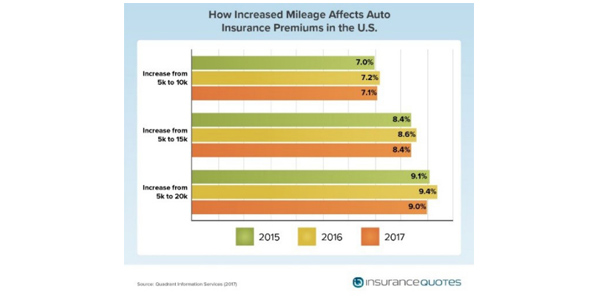

For the third year in a row, insuranceQuotes.com has examined the average economic impact annual miles driven has on the cost of auto insurance. Among the study’s findings, it was revealed that drivers who increase their annual miles from 5,000 to 20,000 see an average rate increase of 9 percent.

“When determining rates, auto insurers typically use mileage as a major factor. But the amount varies considerably depending on where you live. Consumers who live in states with the biggest hikes have more opportunity to save by driving less,” said Laura Adams, senior insurance analyst at insuranceQuotes. “In California, increasing your mileage from 5,000 to 20,000 causes a premium increase over 25 percent.”

Below are the top-five states where drivers see the highest rate increase when annual mileage increases from 5,000 to 20,000 miles:

- California – 25.66 percent

- Alabama – 9.79 percent

- Virginia – 9.21 percent

- Massachusetts – 9.13 percent

- Washington, D.C. – 9.07 percent

Meanwhile, below are the top five states where drivers see the lowest rate increases:

- North Carolina – 0 percent

- Rhode Island – 1.07 percent

- Georgia – 2.53 percent

- Texas – 2.82 percent

- Oregon – 3.06 percent

“When your driving habits change for any reason – such as working from home, having a different commute or retiring, let your insurer know,” said Adams. “Regardless of the financial impact, drivers should always be honest about their mileage, otherwise you risk having a claim denied.”

The full report – which includes full state-by-state data, as well as important analysis and saving tips – is available a by clicking here.