Standard Motor Products, Inc., an automotive replacement parts manufacturer and distributor, reported recently its consolidated financial results for the three months and nine months ended Sept. 30, 2020.

Consolidated net sales for the third quarter of 2020 were $343.6 million, compared to consolidated net sales of $307.7 million during the comparable quarter in 2019. Earnings from continuing operations for the third quarter of 2020 were $36.2 million or $1.59 per diluted share, compared to $22.7 million or $1.00 per diluted share in the third quarter of 2019. Excluding non-operational gains and losses identified on the attached reconciliation of GAAP and non-GAAP measures, earnings from continuing operations for the third quarter of 2020 were $36.2 million or $1.59 per diluted share, compared to $23.1 million or $1.02 per diluted share in the third quarter of 2019.

Consolidated net sales for the nine months ended Sept. 30, 2020, were $845.9 million, compared to consolidated net sales of $896.7 million during the comparable period in 2019. Earnings from continuing operations for the nine months ended Sept. 30, 2020, were $57.7 million or $2.53 per diluted share, compared to $56.3 million or $2.47 per diluted share in the comparable period of 2019. Excluding non-operational gains and losses identified on the attached reconciliation of GAAP and non-GAAP measures, earnings from continuing operations for the nine months ended Sept. 30, 2020, and 2019 were $57.8 million or $2.53 per diluted share and $57.3 million or $2.51 per diluted share, respectively.

Loss from discontinued operations, net of income taxes, in the third quarter of 2020 was $7.6 million compared to $7.9 million in the comparable period last year. The loss pertains to asbestos-related liabilities from a brake business, originally acquired in 1986 and subsequently divested in 1998, which are adjusted in the third quarter each year when the company engages an independent actuary to assess the company’s exposure.

Eric Sills, Standard Motor Products’ CEO and president stated, “We are very pleased with our third quarter results as we set all-time records for both sales and profits in a single quarter. While sales have not fully caught up year-to-date, our profits are now roughly even with the first nine months of 2019, in this year of dramatic ups and downs. Perhaps more important in the long run is that sales — both for us and for the industry as a whole — rebounded so quickly from the April trough, confirming the resilience of our industry and how essential it is to the economy as a whole.

“These last few months also reconfirmed the strength and loyalty of our work force. With minimal precedent to guide us, our people were able to reconfigure our facilities, and establish safety protocols often more stringent than CDC requirements. In the midst of the crisis our frontline employees came to work every day, often six or seven days a week. As a result, we were able to keep our factories and distribution centers running, while protecting the health of our employees. We wish to publicly thank all of our people for their heroic efforts during the crisis.

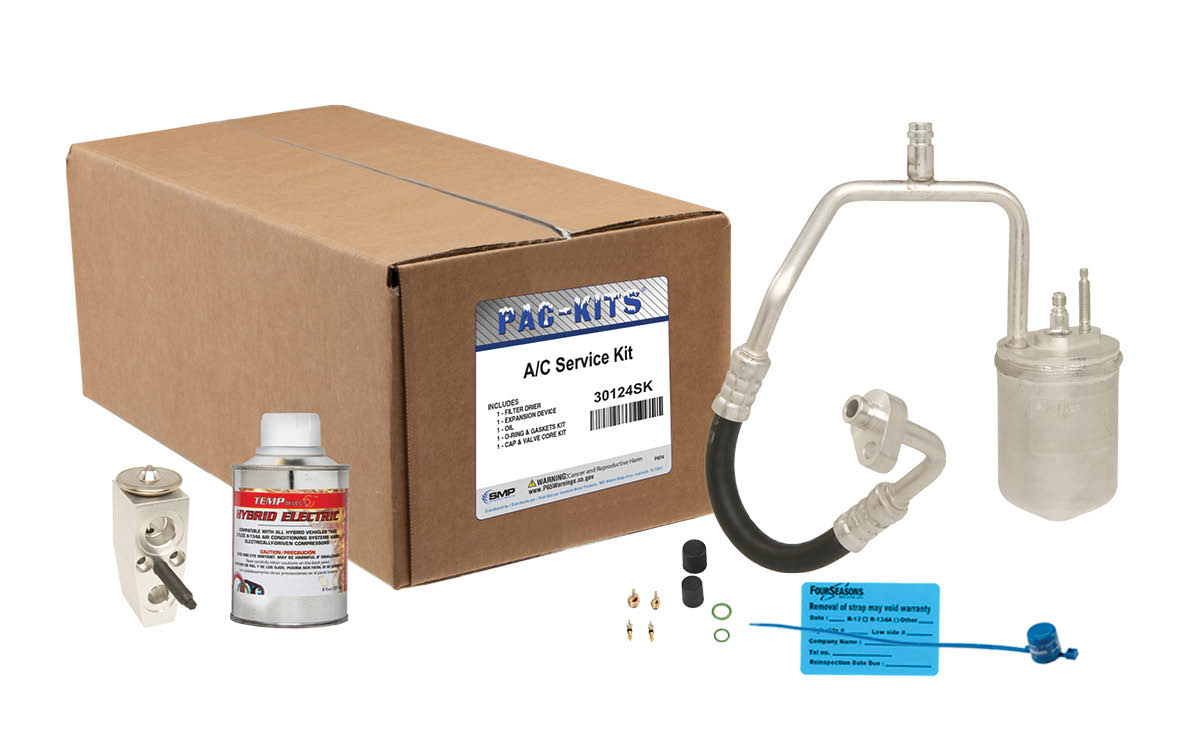

“Our sales in the quarter were strong in both segments. Engine Management sales were up 6.3%, partially offsetting the missed sales at the height of the pandemic. Customer POS was strong throughout the quarter and has carried forward into October, which we believe reflects ongoing pent-up demand from earlier in the year. We anticipate demand ultimately normalizing towards our longer range forecast of low single digit growth. Our Temperature Control sales were extremely strong in the quarter, up 25% over the third quarter last year, the result of very hot summer weather across most of the U.S., following light pre-season orders in the first half of the year.

“On the expense side, as previously announced, we instituted many temporary cost reductions, including limits on travel and other discretionary expenses, as well as a reduction in executive and board of directors compensation, always making sure that none of these actions would affect the long-term health of our company. We anticipate that we will maintain some, but not all, of these reductions in the future.

“Though our crystal ball is somewhat cloudy, with coronavirus infection rates rising again and unemployment still at high levels, we are optimistic looking forward. Accordingly, the board of directors has approved a reinstatement of a quarterly dividend of 25 cents per share on common stock outstanding. The dividend will be paid on Dec. 1, 2020, to stockholders of record on Nov. 16, 2020. We have also reinstated our share purchase program, which has remaining authorization from our board of directors in the amount of $11.3 million.”

Finally, the company announced that Lawrence Sills, executive chairman, is stepping down as an officer of the company and will continue in his role as chairman of the board, effective Jan. 1, 2021. Sills stated, “This change in status reflects the fact that I will be stepping back from day-to-day duties, though I will remain closely involved with the company as board chairman. I am very optimistic about the future. We have assembled an experienced and talented management team, which performed so well during the Covid-19 crisis, and am very confident that the team will continue its outstanding performance for many years ahead.”