As the market awaits a clear signal that either growing new-vehicle inventories or consumer affordability issues will emerge as the main determinant of auto sales trends in the immediate term, new U.S. light-vehicle demand in May is expected to soldier on uneventfully and maintain its unsteady climb.

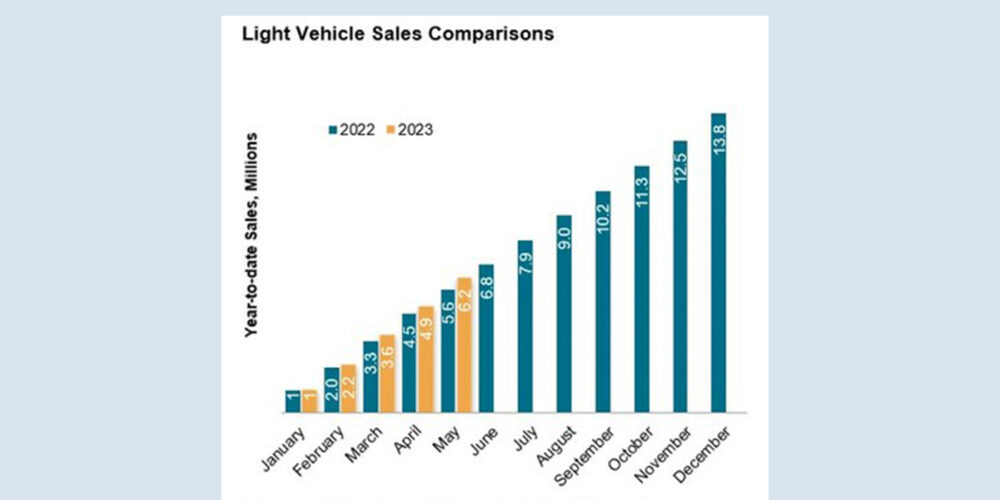

S&P Global Mobility says it projects new light-vehicle sales volume in May 2023 to reach 1.31 million units, up 18% year over year, and representing the 10th consecutive month in which volume has improved from the year-prior level. This volume would translate to an estimated sales pace of 14.5 million units (seasonally adjusted annual rate: SAAR), a step down from the month-prior result, but reminiscent of ongoing monthly patterns in this metric.

On the supply side of the equation, S&P Global Mobility adds supply chain issues have continued the easing that began in the second half of 2022, resulting in consistent increases in retail advertised inventory levels. As the summer months approach, vehicle listings have plateaued at approximately 2 million units, 67% higher than a year ago, according to S&P Global Mobility’s proprietary analysis of advertised dealer inventory.

“With increased supply comes increased negotiating power for consumers in the market for a new vehicle – as 40% of vehicle listings now reflect a price below MSRP, compared to less than 25% a year ago,” said Matt Trommer, associate director of market reporting at S&P Global Mobility. “While certain models continue to be difficult to find, savvy consumers are better positioned to find a deal now than they have been since the pandemic.”

“Auto sales in May are expected to reflect the ongoing market conditions running in opposition of each other; improving inventory, but uncertain consumers,” said Chris Hopson, principal analyst at S&P Global Mobility. “Potential upside to immediate term sales remains as inventory levels progress. However, gathering economic headwinds point to some volatility come the second half of the year.”

Sales volumes over the next several months are not expected to dynamically change from the current trend, according to the analysis. That said, consumer choice buoyed by increased inventory and sustained downward pricing pressure could be restrained by affordability challenges by way of macroeconomic uncertainty, rising interest rates, and tighter credit conditions, according to S&P Global Mobility.

Continued development of battery-electric vehicle (BEV) sales remains a constant assumption for 2023. BEV sales are estimated to be up more than 45% through April 2023, or approximately 110,000 incremental units, compared to the same timeframe in 2022, S&P Global Mobility says. However, with the implementation of the US federal EV incentive eligibility as of April 18, 2023, and ongoing price adjustments from Tesla, monthly BEV share could become a bit more volatile in the upcoming months. On a projected level of 7.6% for May, BEV share is expected to remain on trend. Beyond the pricing developments, a sustained churn of new and refreshed BEVs will continue to promote BEV sales as the year progresses.