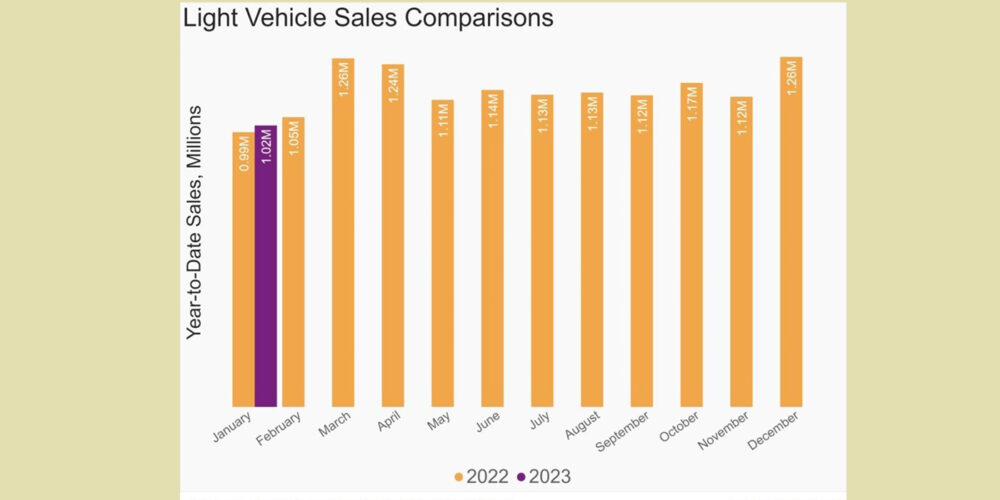

S&P Global Mobility reports with volume for January 2023 projected at 1.015 million units, U.S. auto sales are estimated to translate to an estimated sales pace of 15.5 million units (seasonally adjusted annual rate: SAAR). “While the SAAR reading would be the highest monthly level since May 2021, we’ve seen this pattern before and the underlying dynamics of the market remain in flux,” S&P Global Mobility says.

“Auto consumers continue to be impacted by an uncertain purchase environment. While positive developments regarding mildly retreating vehicle prices and rising pockets of inventory bode well, interest rates remain high and economic headwinds persist,” said Chris Hopson, principal analyst at S&P Global Mobility. “None of these issues will be resolved quickly as we move through 2023. The January 2023 expected SAAR reading may have jumped from the month-prior reading of 13.3 million units, but the unsteady combination of consumers, inventory and economic conditions will dictate monthly new vehicle sales levels.”

| U.S. Light Vehicle Sales | ||||

| Jan 23 (Est) | Dec 22 | Jan 22 | ||

| Total Light Vehicle | Units, NSA | 1,015,700 | 1,263,268 | 991,573 |

| In millions, SAAR | 15.5 | 13.3 | 15.1 | |

| Light Truck | In millions, SAAR | 12.2 | 10.5 | 12.1 |

| Passenger Car | In millions, SAAR | 3.3 | 2.8 | 3.0 |

The S&P Global Mobility auto outlook for 2023 continues to carry a countercyclical narrative: “We expect production levels to continue to develop even as economic conditions are expected to deteriorate through the early stages of next year. The advancing production levels, along with reports of sustained retail order books, recovering stock of vehicles, and a fleet sector that remains starved for product should provide some impetus to auto demand levels even as an economic recession looms. We project 2023 calendar year volume of 14.8 million units, a 7% increase from the estimated 2022 tally,” says S&P Global Mobility.

Battery-Electric Vehicles

Sustained development of battery-electric vehicle (BEV) sales remains a constant assumption for 2023, according to S&P Global Mobility. BEV share is expected to reach 7.4% in January 2023, an all-time record mix level, pushed by the notable Tesla downward price adjustments. While this is the first shot in a BEV price war, the reaction of other auto companies will determine whether the January mix level will be a blip in the trend or a dynamic tipping point in the electrification progress of the market.

For more information, visit www.spglobal.com/mobility.