S&P Global Mobility (formerly the automotive team at IHS Markit) has issued its latest global light vehicle production update.

The global auto industry continues to be influenced by near-term challenges of navigating ongoing supply chain pressures coupled with economic headwinds and intermediate-to-longer term dynamics involving a structural shift from internal combustion to electric propulsion, S&P Global Mobility’s research shows. While semiconductor availability continues to improve, having the right chip for the right vehicle at the right plant can still prove elusive and impact the ability to accelerate production.

Further, in several markets, S&P Global Mobility says it continues to adjust for macro deterioration contributing to demand destruction. In the longer term, vehicle pricing will be a key consideration and a potential headwind to demand, particularly as many markets shift to much higher levels of electrification.

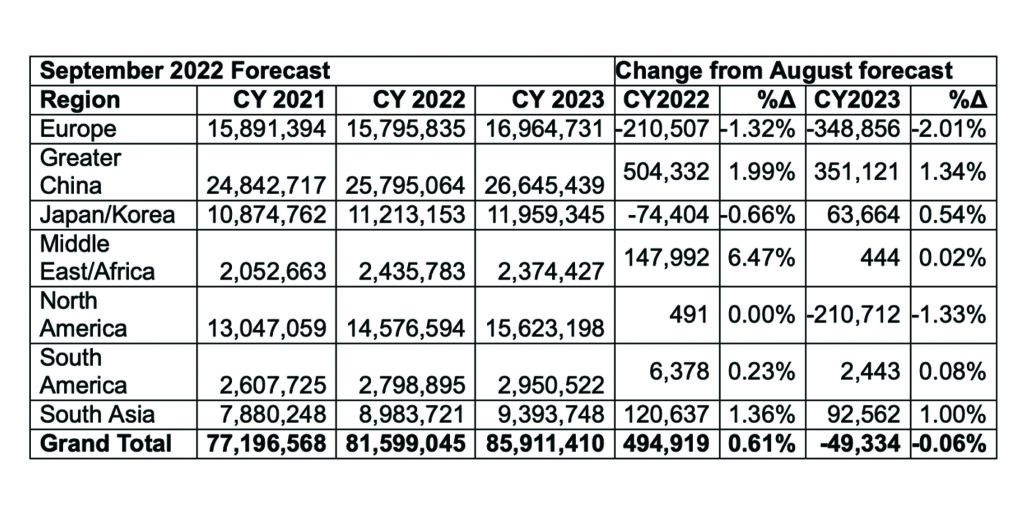

The September 2022 forecast update reflects a near-term upgrade for Greater China due to stronger demand post-COVID lockdowns and robust stimulus effects as well as a stronger near-term outlook for South Asia and Middle East/Africa. However, equally important are the near-to-intermediate term downward revisions particularly focused on Europe and North America, among other regions.

In the extreme near-term, semiconductor availability remains a key factor in the ability to accelerate production growth. In addition, S&P Global Mobility adds it continues to see demand destruction pulling ahead into 2023 for key markets which has direct implications to production and impacts the magnitude/need for inventory restocking.