The automotive specialty-equipment industry, SEMA, has largely weathered the pandemic, with many companies reporting sales growth over the past year and anticipating continued growth in the coming months, according to new SEMA Market Research.

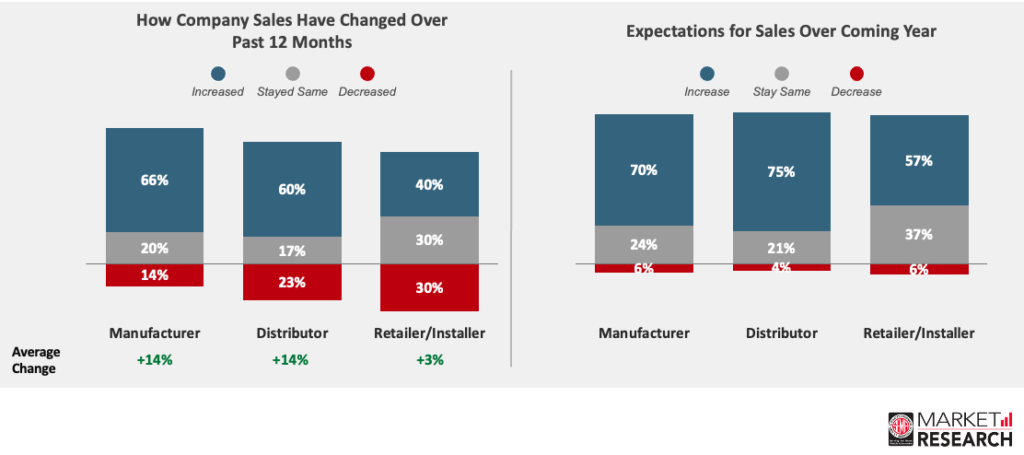

Findings from the new “SEMA State of the Industry—Spring 2021” report indicate that the majority of businesses saw significant sales growth during the pandemic: 66% of manufacturers, 60% of distributors, and 40% of retailers/installers reported increased sales compared to 12 months ago, and nearly three-fourths of all manufacturers and distributors expect sales to increase over the coming year.

Filled with data on how the pandemic has impacted businesses in the automotive specialty-equipment industry, the 63-page market research report helps companies understand how the market is performing. Key findings from the report include:

- The specialty-equipment industry saw minimal staffing disruption because of the pandemic, with most maintaining or growing staffing levels. Additionally, 83% of manufacturers, 77% of distributors, and 63% of retailers/installers plan on hiring more staff over the coming year.

- Many companies selling in the pickup, sports car, and classic segments reported double-digit growth in the past 12 months.

- Manufacturers saw sales increase across many channels, especially direct-to-consumer through their company website and at independent specialty retailers.

- The industry saw growth across a variety of product categories. Manufacturers and retailers saw significant sales growth in performance categories especially, including intake and suspension products.

- According to the U.S. Census Bureau, retail sales at motor vehicle and parts dealers hit $139.5 billion—its highest level in U.S. history. Despite the pandemic, consumers continue to work on their cars.

- According to a survey of Americans conducted by Hertz, over 80% of Americans plan on taking a road trip this summer. This means a lot more driving, and potentially a lot more potential engagement with the specialty-equipment industry.

At a time when most countries, like Japan and the European Zone, are experiencing economic contractions, the U.S. is showing strong growth after the disruption from the pandemic. This strong growth is expected to continue through the rest of 2021, as the services part of the economy fully reopens.

To learn more about the current state of the specialty-equipment industry and outlook for the future, download the new “SEMA State of the Industry—Spring 2021” report today at www.sema.org/research.