A combination of record numbers of miles driven, increased frequency and severity of collisions, and extreme weather has crimped U.S. auto insurer profitability, resulting in rate increases for 26 percent of customers and a strain on customer satisfaction. According to the J.D. Power 2017 U.S. Auto Insurance Study released recently, price satisfaction declined this year, even as other areas of the overall customer experience have improved.

The study found that the number of customers receiving an annual rate increase of more than $200 per vehicle has more than doubled during the past four years, and that’s having a profound effect on customer satisfaction. Price satisfaction scores among customers who receive a price increase of $200 or more are, on average, 188 points lower than among those who experience price increases of just $25 or less. This shows that auto insurers need to do a better job of increasing the perception of value in the services they provide.

“Differentiating on service and demonstrating the value of the policy for premiums paid is going to be the key to improving customer satisfaction,” said Greg Hoeg, vice president of U.S. insurance operations at J.D. Power. “As the amount of losses continues to increase for a myriad of reasons, premiums must go up for carriers to remain profitable. However, carriers that are successful in getting beyond price by clearly communicating and demonstrating value through smooth claims processing, exceptional customer service and a great selection of offerings will emerge as leaders. Initiatives such as usage-based insurance programs and other proactive communications that show customers what they are getting for their money will help that value perception.”

Key Findings

- Overall satisfaction improves while price satisfaction declines: Overall customer satisfaction with U.S. auto insurers improves in 2017 and is now at a historically high level (819 on a 1,000-point scale). Despite this improvement, satisfaction scores in the price factor have declined for a second consecutive year.

- Size of premium increase correlates with satisfaction: Satisfaction scores average 726 among customers who experience premium increases of $25 or less. Among those with an increase of $200 or more, satisfaction declines by 188 points to an average of 538.

- All hail, Texas: While price satisfaction at the national level declines just 1 point in 2017, there are wide variations in price satisfaction at the regional level. Texas experiences the sharpest decline (-13 points) amid a rash of catastrophic losses — on top of collision losses — stemming primarily from hail storms. Texas is followed by New York (-10 points), the Northwest region (-9 points) and the Southwest region (-5 points) among those regions experiencing the largest year-over-year declines in price satisfaction.

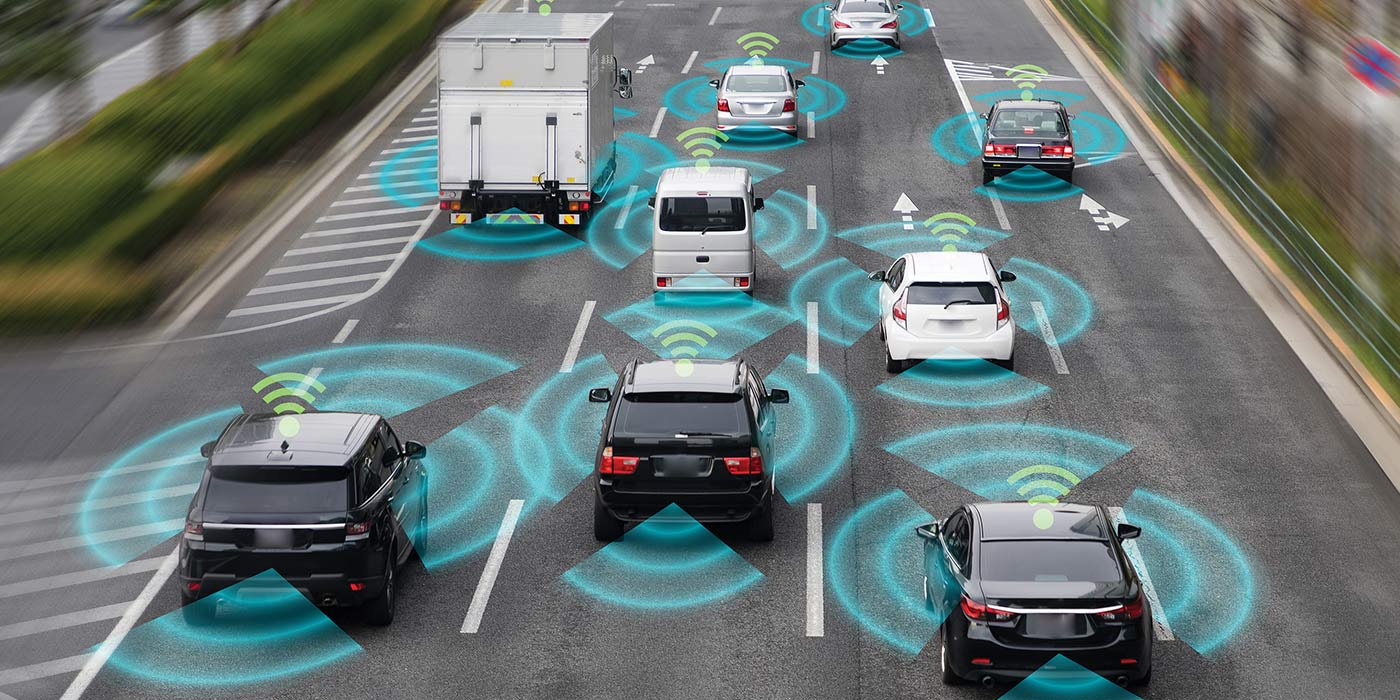

- Telematics increase customer perception of value: Usage-based insurance programs, which leverage telematics technology to set insurance premiums based on how far and how safely a customer drives, may be the great equalizer when it comes to customer perception of price. Price satisfaction scores are between 54 and 72 points higher among customers who are usage-based insurance participants, even when those participants have experienced premium increases.

- Communication clarifies value: Carriers can minimize the negative impact of insurer-initiated price increases by providing clarity and transparency in policy coverage. Satisfaction among customers who received a price increase averages 645 compared with 768 among customers without an increase; however, when carriers notify customers of a price increase in advance of the change, provide helpful information on customers’ bills, and when customers say they completely understand their policy, price satisfaction averages 755.

All regional rankings are available online here.

The 2017 U.S. Auto Insurance Study examines customer satisfaction in five factors (in order of importance): interaction; policy offerings; price; billing process and policy information; and claims. The study is based on responses from 45,624 auto insurance customers, and was fielded from February to April 2017.

For more information about the 2017 U.S. Auto Insurance Study, click here.