Written by Mike Chung, director, market intelligence, Auto Care Association

Here we are at year-end – what a year it’s been! While the past year has had no shortage of challenges and uncertainty, I’m pleased to report that the outlook for 2022 is strong based on a survey of our membership. As detailed below, challenges have shifted over time, with new ones steadily emerging throughout the year. While the “top concerns” may not be surprising, the agility and adaptability of the automotive aftermarket continue to inspire and reassure.

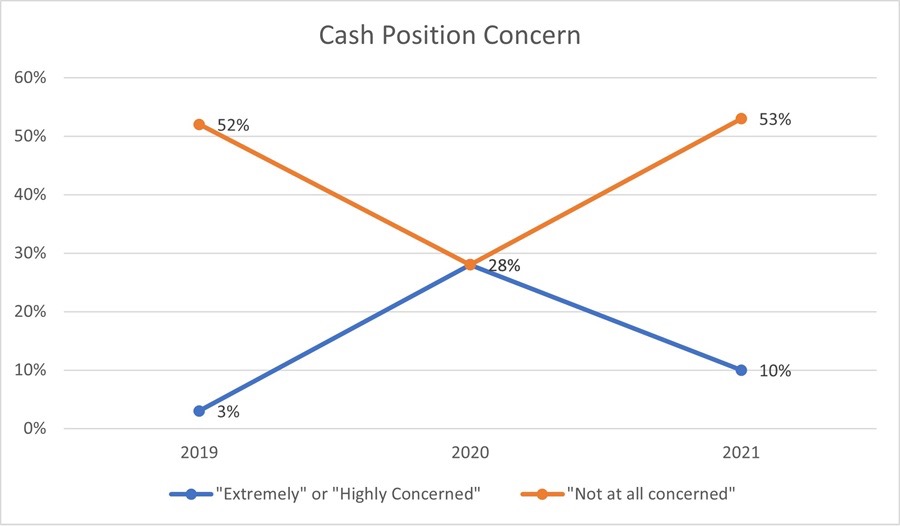

Cash Position Concern: Then and Now

Concern with company cash position returned to pre-pandemic levels in 2021. About half of aftermarket companies were “not at all concerned” in 2019 (52%); this figure decreased to 29% in 2020 before rebounding to 53% in 2021. Similarly, only a few percent were highly or extremely concerned in 2019 (3%). This rose dramatically to 28% in 2020 before subsiding to 10% in 2021:

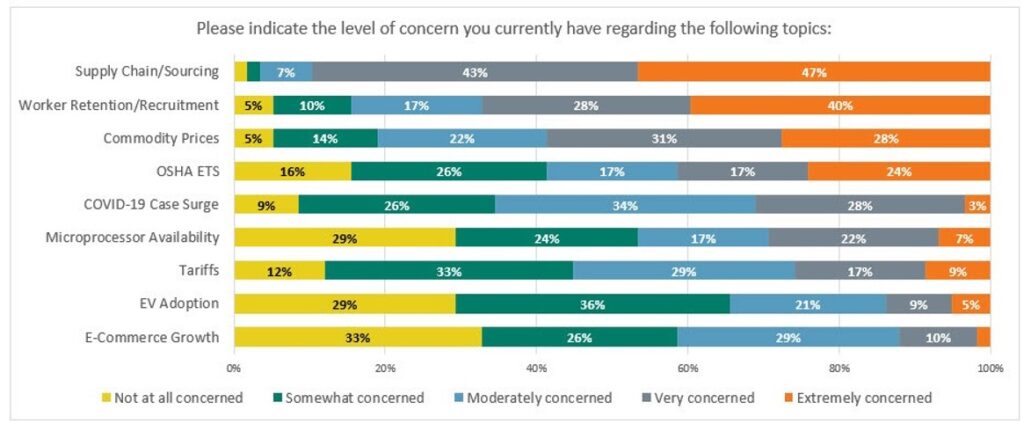

Supply Chain and Labor are Biggest Challenges

As we close out 2021, the big concerns in the aftermarket are supply chain and labor issues:

Supply chain is of high concern (Top 2: Extremely + Very concerned) for 90% of our members. A few reasons this spikes to the top:

- “Inflation and supply chain fragility are of our top concerns … we have had to raise prices …across all of our products and make significant investments to inventory as JIT models do not support customer demands …”

- “Supply chain and commodity prices – costs continue to rise and we are hopeful they will moderated in the first quarter of 2022.”

- Labor issues is of high concern to two-thirds of members (68%). Like supply chain, worker recruitment/ retention is a daily topic in the news. Members share:

- “We are behind other industries in pay scale and benefits. We are offering referral bonuses, COVID-19 hazard bonuses, and have given multiple pay rate adjustments in both 2020 & 2021 to keep staff from leaving.”

- “[It’s a] full court press to retain and recruit as we expand back to capacity.”

- “Hard to find quality in the workforce. Wages are going up to retain employees and prices will follow.”

Current policy developments regarding COVID-19 vaccine and testing requirements are also of high concern – OSHA’s Emergency Testing Standard is of high concern to 41% of our members due to potential impacts on employment and administrative costs/burden:

- “If adopted I’d lose 50-60% of my employees.”

- “COVID testing will likely create employee issues and/or additional record-keeping and expense.”

Cliff Hovis, President of Hovis Auto & Truck Supply, shared that “[about half] of my employees are vaccinated – many have said they would leave if vaccines are mandated.” With labor being hard to find, “losing 10% of staff would be devastating.”

Uncertainties Persist as Firms Look Ahead

When asked to describe “any other issues that your organization is struggling with”, members shared other concerns related to the added costs and uncertainties associated with disrupted supply chains and sourcing, ultimately leading to increased end-user costs:

- “Container costs, freight costs, product delays”

- “Continued raw material volatility & transportation issues impacting performance and driving costs higher.”

- Many aftermarket organizations find the 2022 planning process challenging as uncertainty is prevalent:

- “Hard to gauge what ‘true demand’ is in the US Aftermarket. What is normal? What will 2022 bring?”

- “Challenge is trying to find the new ground floor amongst true inflation increase vs opportunistic price increases. Wrestling now with how to reset our standard costs but not lose touch with market pricing and competitiveness.”

- “It makes programs and pricing a lot more difficult and that interjects uncertainty into our cash flow and planning.”

As noted above, new policy development adds to the challenge for business owners – Hovis (Hovis Auto & Truck Supply) notes that the potential change of “Long Term Capital Gains” is significant for some and is driving consolidation as some business owners are selling their businesses this year, leaving the industry with fewer distributors. “The increase in taxes impacts growth of companies: if they pay more, they grow less.”

The day-to-day realities of inventory management continue to be daunting, and many companies are constantly adjusting operations to adapt to changing market conditions, acknowledging the uphill climb:

- “Once again, we are spending drastically more time managing inventory levels and carrying more back-up / safety stock. This only intensifies the labor and space issues that also exist.”

- “Order more of what we can get and not doing annual returns.”

- “Taking into consideration an impact per month based on port and intermodal shipments. With these delays continuing, it is tough to gauge true demand.”

- “Increase in Lead-times. Loss of Revenue. Decrease in Cash Flow.”

- That said, companies are staying the course, expanding their supplier community, and adjusting their focus and operations as appropriate:

- “Outside of having to raise prices, our strategic plan remains in place as designed in 2020 and 2021.”

- “We are looking at using more suppliers to attempt to get supply. Adding to inventory and safety stocks.”

- “We are looking for domestic suppliers to feed our supply chain and transitioning some team members to alternate positions to fill in workflow disruptions.”

- “We are focusing less on revenue and more on our margin in an effort get more value out of each interaction with our customers. While avoiding taking on significant CapEx and OpEx and allowing us to shore up the foundation of our business and our culture to make sure that we continue to have a sustainable business with a healthy culture that does not get burned out by the stressors and dynamic demands of a unique time in the market.”

- “We want to be vertically integrated as much as possible. Acquiring tooling or even companies that would not have been considered in the past, such as packaging.”

Addressing Supply Chain Issues

When asked specifically about their response to supply chain challenges, aftermarket companies are most frequently:

- Increasing inventory supply

- Expanding their supplier community

- Ordering items further in advance

Ryan Bickle is Vice President of Sales at Warehouse Inc./S&W Supply in western Kansas. As availability of numerous products – batteries, rotors, gloves, to name a few – varied throughout the year, he had to play four-dimensional chess in accounting for lengthening order fulfillment timeframes, selling to new versus long-time customers, fluctuating commodity prices, and quantity / timing of product orders.

Other tactics include:

- “Moving more production to local factories (local production, local consumption) especially here in North America.”

- “Offering customers additional terms and discounts over normal pre-season orders, just to stay ahead of demand.”

- “Ordering new product lines.”

- “Setting proper expectations with our customers on the products and service they expect.”

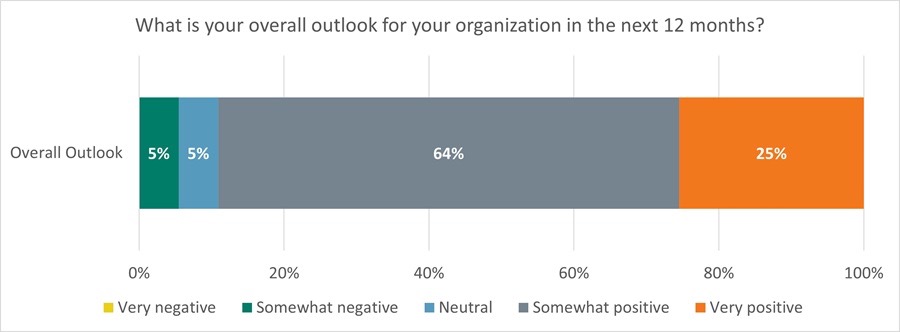

Drivers of Positive Outlook

Despite the numerous challenges, automotive aftermarket businesses have an overwhelmingly positive outlook – nearly 90% have a positive outlook for the next year:

Three major themes drive the positive outlook:

Strong demand:

- “Demand is strong and revenue will continue to grow as long as we can keep staffed and stocked”

- A robust industry:

- “Strong market fundamentals – aging and growing car parc.”

- “We’re in a strong financial and inventory position with a business grounded in a strong culture and loyal customer base.”

- Fewer new vehicles available:

- “Low volume of new vehicles to sell will continue to drive greater repair needs.”

- Our members are realists – they recognize the challenges and are appropriately prudent …

- “Our outlook is very positive but we are going up against some difficult comparisons. We are also concerned that inflation and continuing COVID issues will dampen consumer spending in 2022.”

- … while the industry solves the puzzle of supply chain logistics amidst changing driving behaviors:

- “The demand is high for our products… we just have to figure out where to get them.”

Bickle (of Warehouse Inc./S&W Supply) shared an innovative solution for industrial customers for tank heaters – in addition to servicing 35 independent Federated affiliates, his company supplies field equipment to oil production companies in Kansas. Going into the winter season, tubular 48-inch tank heaters were in high demand, but the thermostats are not available until March 2022. Bickle had his customers use the thermostats from their old units in the new heaters as a stopgap.

The market is expected to reward the nimble:

- “Those that are in position to adapt quickly to the supply challenges should be optimistic for mid- and long-term success.”

- “We are in an acquisition / growth mode and the industry is opportunity rich with regard to consolidation.”

Before the COVID-19 pandemic, tariffs worried Mike Fiorito, Vice President at KYB Americas. Now, they are the least of his concerns. A government-mandated manufacturing plant shutdown in Southeast Asia due to COVID-19 is forcing Fiorito and his team to reconfigure raw material sourcing and shipping, as well as modifying production output and scheduling at other factories. This of course ties into labor considerations when evaluating the possibility of adding another production shift. With low unemployment and other large companies competing for quality employees, the potential for mandatory vaccination / testing is a tangible concern for Fiorito.

Aftermarket leaders remarked on the renewed appreciation for in-person events and the potential for new business relationships. At AAPEX, Hovis marveled that every meeting with a manufacturer was with a potential business partner – with the need to diversify the supplier base, many companies are eager to explore new relationships, calling on industry associates, fellow program group members, and colleagues to vet their potential new business suppliers.

Similarly, Bickle created roadshow events to convene vendors with independent jobbers. The ability to see products in person, talk with representatives face-to-face (or at least mask-to-mask) continues to promote relationship building and product awareness.

While the challenges facing the automotive aftermarket are clear, the marketplace is healthy with forward-looking, confident leaders across the industry – as a few shared, there is “Lots and lots of opportunity in front of us” and “We’re in a strong financial and inventory position with a business grounded in a strong culture and loyal customer base.”

Best wishes to you all for a healthy, safe, and refreshing holiday season as we look to a 2022 filled with renewal, continued optimism, and prosperous results!