SPRINGFIELD, Mo. – O’Reilly Automotive has announced record revenues and earnings for its fourth quarter and full year ended Dec. 31, 2013. The results represent 21 consecutive years of comparable store sales growth and record revenue and operating income for O’Reilly since becoming a public company in April of 1993.

Sales for the fourth quarter ended Dec. 31, 2013, increased $133 million, or 9 percent, to $1.62 billion from $1.49 billion for the same period one year ago. Net income for the fourth quarter increased $20 million, or 15 percent, to $152 million (or 9.4 percent of sales) from $133 million (or 8.9 percent of sales) for the same period one year ago. Diluted earnings per common share for the fourth quarter increased 23 percent to $1.40 on 109 million shares versus $1.14 for the same period one year ago on 116 million shares.

“We are very pleased to report we finished 2013 with another strong quarter of record-breaking results. Thanks to the continued hard work of Team O’Reilly, we generated a 23 percent increase in diluted earnings per share for the fourth quarter, which represents our 20th consecutive quarter of 15 percent or greater adjusted diluted earnings per share growth,” said Greg Henslee, the company’s president and CEO. “Our dedicated Team Members delivered a comparable store sales increase of 5.4 percent for the fourth quarter, which exceeded our expectations. Our team’s continued focus on expense management and profitable growth resulted in a record-breaking fourth quarter operating margin of 15.8 percent. I would like to take this opportunity to thank the 62,000 members of Team O’Reilly for their dedication and hard work and congratulate them on another record-breaking quarter. Our team’s commitment to providing consistently excellent customer service remains the key to our current and long-term success.”

Full-Year Financial Results

Sales for the year ended Dec. 31, 2013, increased $467 million, or 8 percent, to $6.65 billion from $6.18 billion for the same period one year ago. Net income for the year increased $85 million, or 14 percent, to $670 million (or 10.1 percent of sales) from $586 million (or 9.5 percent of sales) for the same period one year ago. Diluted earnings per common share for the year ended Dec. 31, 2013, increased 27 percent to $6.03 on 111 million shares versus $4.75 for the same period one year ago on 123 million shares.

Henslee stated, “Diluted earnings per share increased 27 percent to $6.03 in 2013, representing our fifth consecutive year of 25 percent or greater adjusted earnings per share growth, driven by our industry-leading comparable store sales increase of 4.3 percent and our record full-year operating profit of 16.6 percent. We are pleased to consistently deliver these record-breaking results to our shareholders, and I would once again like to thank and congratulate Team O’Reilly on another year of meeting our sales and profitability goals.”

Henslee continued, “2014 is off to a strong start, with the opening of our 25th distribution center in central Florida. As we previously discussed, this new DC will allow us to better support our growing store base in central Florida and continue growing into southern Florida. We also continue to believe in the strength of the long-term demand drivers for our business, and we are committed to the consistent execution of our proven dual market strategy. Based on our confidence in our industry fundamentals and business model, we are establishing our comparable store sales growth guidance range of 4 percent to 6 percent for the first quarter and 3 percent to 5 percent for the full year of 2014, as we look forward to another successful and profitable year.”

Share Repurchase Program

During the fourth quarter ended Dec. 31, 2013, the company repurchased 2 million shares of its common stock at an average price per share of $124.11, for a total investment of $246 million. During the year ended Dec. 31, 2013, the company repurchased 8.5 million shares of its common stock at an average price per share of $109.38, for a total investment of $933 million. Subsequent to the end of the fourth quarter and through the date of this release, the company did not repurchase a material number of shares of its common stock. The company has repurchased a total of 40.6 million shares of its common stock under its share repurchase program since the inception of the program in January of 2011 and through the date of this release, at an average price of $82.61, for a total aggregate investment of $3.35 billion.

Today, the company also announced that its board of directors has approved a resolution to increase the authorization amount under its share repurchase program by an additional $500 million, raising the aggregate authorization under the program to $4.0 billion. The additional $500 million authorization is effective for a three-year period, beginning on Feb. 5, 2014. As of the date of this release, the company had approximately $645 million remaining under its current share repurchase authorizations.

Federated Announces New Affiliate Member

A collaboration with the Association of Independent Oil Distributors will focus on mutual benefits for the respective members.

Federated Auto Parts Distributors announced it is entering into a collaboration with the Association of Independent Oil Distributors (AIOD) – one it said will focus on mutual benefits for the respective members.

“Federated is constantly looking at ways to improve value for all constituents and this agreement provides that,” said Sue Godschalk, president of Federated. “This collaboration provides added volume and opportunities for our suppliers, new partners for our members, and added supply points and products for shop customers. We have enjoyed working closely with several AIOD members in the past and this agreement will expand and create further opportunities for both Federated and AIOD.”

APA to Host Annual General Meeting

The event will be held on March 26-28, at the Grand Hyatt San Antonio River Walk in San Antonio.

PGI Wins Quality Award from NAPA Auto Parts

Premium Guard, Inc. was recognized for its leadership and excellence in quality.

Vast-Auto Awards Top Stores, Suppliers at Annual Convention

During the event, the Vast-Auto team recognized its distribution customers and unveiled its new brand image and programs.

Auto Parts 4 Less Group Inc. Announces Growth Strategy

The company said it aims to provide a seamless and reliable platform for high-quality automotive parts and accessories at competitive prices.

Other Posts

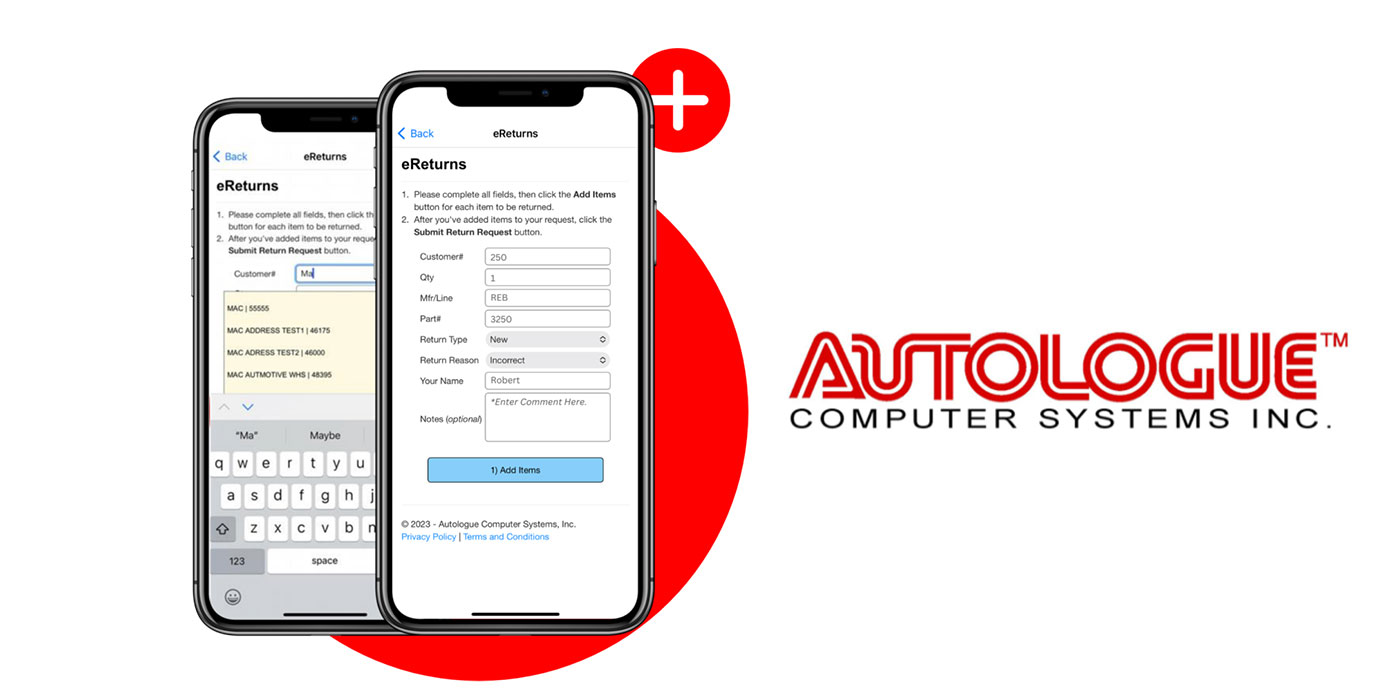

Autologue Creates Software Solution to Manage Customer Returns

The new eReturns module enables the shop to log a part into the app, select a return reason and view the progress of the return process.

APH Expands with Iowa Location

Kurt Croell’s Auto Parts store in New Hampton, Iowa, joined APH and now operates under the name Auto Value of New Hampton.

Fenix Parts Acquires Pacific Rim Auto Parts

Pacific is a specialty automotive recycler focused on eCommerce part listings and sales.

Advance Auto Parts Announces ‘National Battery Day’ Promo

DieHard battery giveaways and complimentary battery testing will be part of nationwide festivities held on Feb. 18.