The new vehicle retail sales pace in June is expected to be lowest for the month since 2012, according to a forecast developed jointly by J.D. Power and LMC Automotive.

The new vehicle retail sales pace in June is expected to be lowest for the month since 2012, according to a forecast developed jointly by J.D. Power and LMC Automotive.

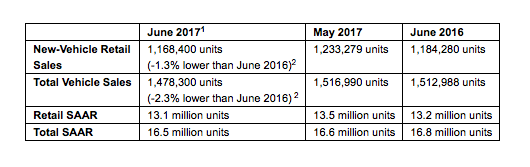

Retail sales in June are anticipated to reach 1,168,400 units, a 1.3 percent decrease compared with June 2016. The seasonally adjusted annualized rate (SAAR) for retail sales is expected to be 13.1 million units, a decrease of 51,000 units from a year ago. Retail sales through the first half of 2017 are projected to be down 1 percent from last year.

“The auto industry is pacing toward its weakest first half since 2014,” said Deirdre Borrego, senior vice president of automotive data and analytics at J.D. Power. “While the retail selling rate has declined in four of the first six months, the broader concern remains the negative health indicators behind the sales results.” Total incentive spending in the marketplace has risen to a record $25.2 billion through June, up 11.7 percent or $2.6 billion from last year. On a per unit basis, spending for the average new vehicle through June was $3,770, up $416 from a year ago. On trucks and SUVs, spending was at an average of $3,645, up $484, while on cars, spending was $3,983, up $345.

J.D. Power and LMC Automotive U.S. Sales and SAAR Comparisons

- The average new-vehicle retail transaction price to date in June is $31,720, a record for the month, surpassing the previous high for the month of $31,073 set in June 2016.

- With record transaction prices for the month, consumers are on pace to spend $37.1 billion on new vehicles in June, about $263 million more than last year’s level and a record for the month.

- Average incentive spending per unit to date in June is $3,661 per unit, a record for the month, and surpassing the previous high for the month of $3,370, set in June 2016. Spending on trucks and SUVs is $3,494, up $350 from last year. Spending on cars is $3,955, up $249.

- Incentives as a percentage of MSRP are at 10 percent so far in June, and on pace to exceed the 10 percent level for 11th time in the past 12 months.

- Trucks account for 63.7 percent of new-vehicle retail sales through June 18 – the highest level ever for the month of June – making it the 12th consecutive month above 60 percent.

- Days to turn, the average number of days a new vehicle sits on a dealer lot before being sold to a retail customer, remained at 70 through June 18. This is the highest level since July 2009 (80 days).

- Fleet sales are expected to total 309,900 units in June, down 5.7 percent from June 2016 on a selling day adjusted basis. Fleet volume is expected to account for 21 percent of total light-vehicle sales, a decrease from 21.7 percent in June 2016.

Jeff Schuster, senior vice president of forecasting at LMC Automotive, said, “As the U.S. auto market enters the fourth month in a row of a sub-17 million unit selling rate, nerves are being tested. The primary driver of the decline in the total sales pace is a pullback in fleet volume, which is projected to be down 8 percent for the first half of 2017, while retail sales, assisted by elevated incentives, is projected to contract by 0.6 percent for the same period. It will be challenging in the second half of the year to keep pace with 2016, so some additional weakness and further risks are expected in both fleet and retail volume, but a year still expected above 17 million units should not be considered a poor performance.”

The prolonged pullback in fleet volume combined with the leveling off of the retail market has led to another trimming of the outlook for 2017. LMC’s forecast for 2017 total light-vehicle sales has been cut to 17.1 million units, down from 17.2 million last month and a decline of -2.6 percent from 2016. The retail light-vehicle outlook also has been reduced by 50,000 units but continues to round to 13.9 million units, a decline of -1.8 percent from 2016. Fleet volume is now expected to be down 6.1 percent from 2016.