From BodyShop Business

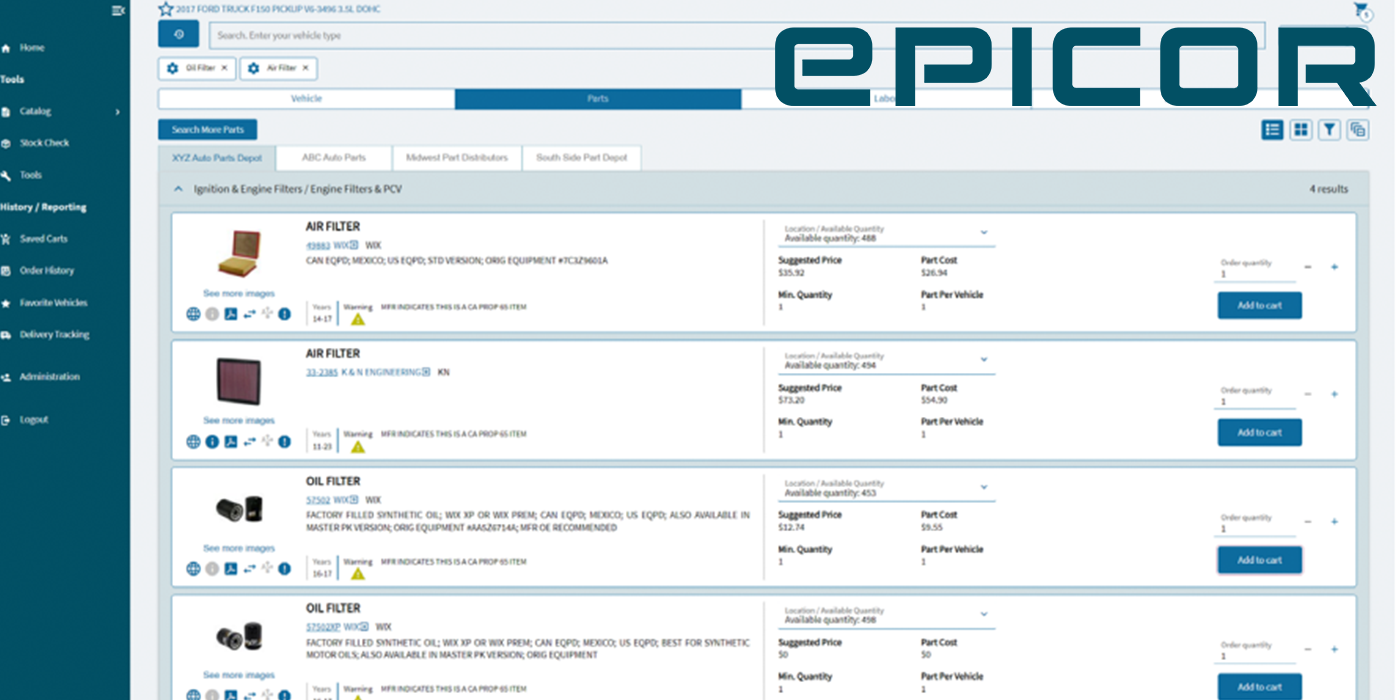

A new market study by Global Market Insights indicates that the Automotive Electronics Market size was valued at more than $270 billion in 2017 and will grow at a CAGR of more than 6.5 percent from 2018 to 2024. The study shows how the automotive electronics control unit (ECU) market has experienced lots of growth over the past two decades with the influx of technology within vehicles.

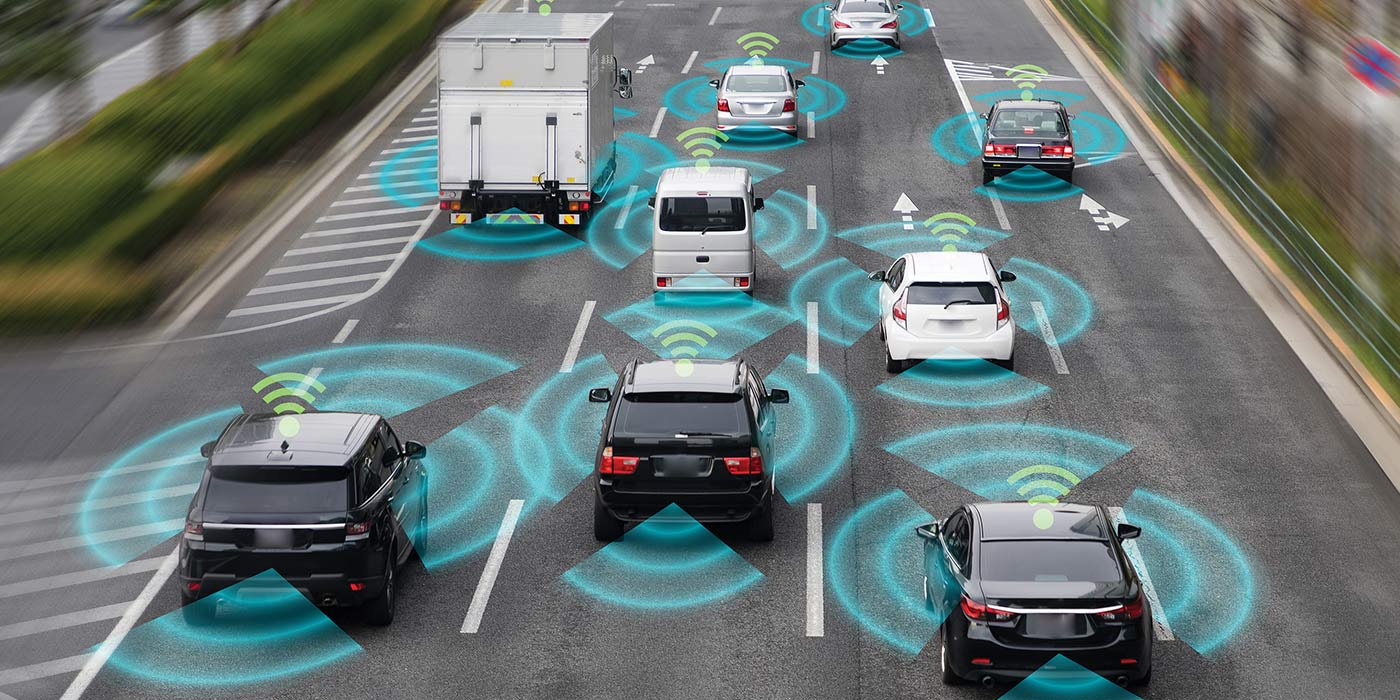

The International Organization of Motor Vehicle Manufacturers had revealed that 97,302,534 cars and commercial vehicles were manufactured across the globe in 2017. The number of ECUs in a car could be anywhere from 70 to more than 150, depending on the type of vehicles, indicating the massive demand that exists for the automotive ECU industry. The large number of ECUs have allowed enhanced safety features and external connectivity solutions to be installed in high-end as well as low-cost vehicles. Commercial vehicles have especially benefitted from the ECU’s ability to regulate the fuel injection system, as increased fuel efficiency plays a vital role in achieving economical goods transportation.

Notable advancements in ECUs have stimulated auto manufacturers to find ways to reduce emissions through efficient control systems, ushering in a transformation of the automotive ECU industry and leading to the growth of smart technologies. The advent of electric vehicles has furthered the development of ECUs required for complex monitoring and operating of a vehicle. Considered to be a rapidly expanding source of remuneration for the automotive ECU market, the battery electric vehicles (EVs) are gaining increased momentum with each passing year.

Worldwide environmental concerns have been the primary driver for the EV industry, coercing nations to invest heavily into boosting the adoption of EVs.

According to the U.S. government, a huge amount of greenhouse gas emissions in the country originates from the transportation sector and, in 2016, almost 23 percent of it was contributed by medium- and heavy-duty commercial vehicles. As such, not only electric passenger and luxury cars but electric commercial vehicles have also started to attract demand from fleets and major corporations to cut down on their carbon footprint. Tesla, an innovator in the EV industry, has developed all-electric semis for the commercial sector, offering significant power and range to help customers maintain their bottom line while being environmentally friendly. Representing a lucrative application scope for the automotive ECU market, the Tesla heavy-duty tractor trailers can handle a weight of up to 80,000 pounds at full speed while giving a range of 300 to 500 miles.

Tesla has projected that by 2022, it will have received orders for about 100,000 semis, with companies like UPS, Pepsi, Walmart, DHL and many others having already placed orders for the electric trucks. As other automobile manufacturers join the race for electric heavy-duty vehicles, the automotive ECU market will experience a considerable upsurge in investments to speed up productions. The International Energy

Agency reported that in 2017 itself, the number of EVs on roads reached 3.1 million. In Europe, there was a 40 percent rise in electric car sales in the first half of 2018, signifying that the EV industry is a budding customer base for the automotive ECU market, with growing inclination toward incorporating commercial EVs within fleets.

Although electric trucks have been used on the streets for many years now, the increased affordability of the technology has allowed vehicle makers to design and introduce new products. For instance, Piaggio Commercial Vehicles’ electric power range has been providing customers with clean medium-duty commercial vehicles with a comfortable power delivery system and appreciable range for more than 20 years. The automotive

ECU industry is thriving due to the efforts of companies that want to bring forward the transition toward a greener transport industry, such as Daimler, which is developing a 25-ton truck, and Proterra, which has designed an electric public transportation bus.

Poised to surpass $95 billion in earnings by 2024, the automotive ECU market is dominated by key industry participants like Bosch Group, Delphi Technologies, Hyundai MOBIS, Mitsubishi Electric Corp, Continental AG and others. Rising awareness about ADAS and other safety systems to prevent road accidents along with continuous research into designing powerful, more efficient ECUs will significantly propel the automotive ECU industry over the coming years.

For more information, click here.