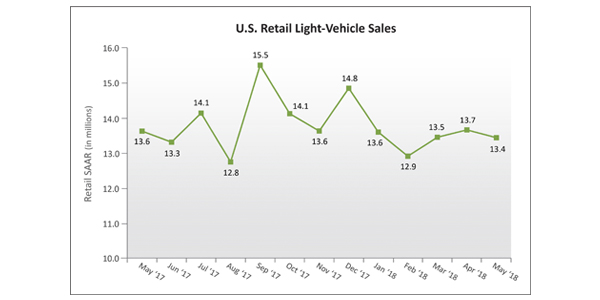

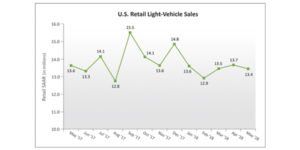

The new-vehicle retail sales pace in May is expected to fall from year-ago levels, according to a forecast developed jointly by J.D. Power and LMC Automotive. The seasonally adjusted annualized rate (SAAR) for retail sales is expected to be 13.4 million units, down 200,000 from a year ago. Retail sales are projected to reach 1,270,200 units, a 1 percent decrease on a selling day adjusted basis compared to May 2017. (May 2018 has one more selling day than May 2017.) Without the selling day adjustment, retail sales would be up 3 percent.

The new-vehicle retail sales pace in May is expected to fall from year-ago levels, according to a forecast developed jointly by J.D. Power and LMC Automotive. The seasonally adjusted annualized rate (SAAR) for retail sales is expected to be 13.4 million units, down 200,000 from a year ago. Retail sales are projected to reach 1,270,200 units, a 1 percent decrease on a selling day adjusted basis compared to May 2017. (May 2018 has one more selling day than May 2017.) Without the selling day adjustment, retail sales would be up 3 percent.

“May represents another modest deterioration of the retail sales pace, but volumes still remain relatively strong from a historical perspective,” said Thomas King, senior vice president of the data and analytics division at J.D. Power. “More notable is that average transaction prices are up $1,192 month to date, while incentive spending per unit is flat compared with the same period last year at $3,665 per unit. This is good news for manufacturers given that the Memorial Day holiday weekend is one of the busiest car-buying periods of the year, with almost 250,000 vehicles sold over the holiday weekend last year.

With the extra selling day in 2018, consumers are expected to spend more than $41 billion on new vehicles in May, nearly $2.7 billion more than last year.

J.D. Power and LMC Automotive U.S. Sales and SAAR Comparisons

- The average new vehicle retail transaction price to date in May is $32,380, a record for the month, surpassing the previous high for the month of $31,188 set in May 2017.

- Average incentive spending per unit to date in May is $3,665 per unit. Through the first five months of the year spending is $3,898, up $128 from the prior year.

- Consumers are on pace to spend $41.1 billion on new vehicles in May, nearly $2.7 billion more than last year’s level.

- Trucks account for 67 percent of new vehicle retail sales through May 20 – the highest level ever for the month of May – making it the 23rd consecutive month above 60 percent.

- Days to turn, the average number of days a new vehicle sits on a dealer lot before being sold to a retail customer, is 68 through May 20, down two days from last year.

- Fleet sales are expected to total 297,700 units in May, up 0.9 percent from May 2017. Fleet volume is expected to account for 19 percent of total light-vehicle sales, which is flat vs. last year.

Jeff Schuster, president, Americas operations and global vehicle forecasts at LMC Automotive, said, “The U.S. auto market’s ability to shrug off the volatility surrounding trade and tariff talks is remarkable. Despite the risks, volume is holding and a calmness prevails. Expectations of a managed slowdown from the 2016 peak remain on target, but the industry’s biggest challenge over the next 18 months will be the collective discipline to manage fleet volume and incentive spending.”

LMC’s forecast for 2018 total light-vehicle sales is now rounding up to 17.1 million units from 17 million, a decrease of 1 percent from 2017. The retail light-vehicle forecast is consistent with last month at 13.8 million units, a decline of 1.6 percent from 2017. Fleet volume is expected to grow by 80,000 units, or 2.3 percent, and represents 19.4 percent of total light-vehicle sales.