By Bruce Kratofil, Babcox Audience Insights Manager

Every other year, we take an in-depth look at how readers of Brake & Front End, ImportCar and Underhood Service work in and manage their shops. We do this in a survey called the Tech Group Profile.

This survey tells us a lot about who our readers are and how they work. In this article, we are going to look at some of the chief concerns they have about their businesses.

What’s their Worry?

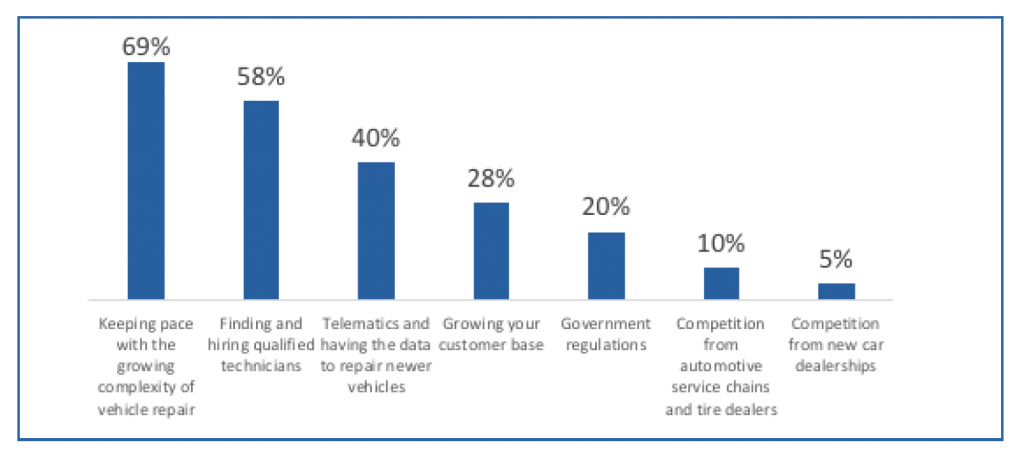

A key question we ask every time we conduct the survey is, “What are your primary concerns regarding the future of your shop?” We presented them with a list and asked them to select all that cause them to worry.

As you would expect, a constant worry of shop owners, “Finding and hiring qualified technicians,” was on the list.

It was named a worry by 58% of respondents. However, it wasn’t the top worry. The top concern, named by 69%, was “Keeping pace with the growing complexity of vehicle repair.” The full list is shown below. (The respondents could select multiple items.)

The chart shows that it isn’t competition that’s worrisome, for competition from auto service chains was named by only 10%, and competition from new-car dealerships was only a worry for 5% of the respondents. Finding more customers is only a worry for a little more than a quarter of the respondents. But keeping up with vehicle technology is selected by more than two-thirds. Another technology-related worry – “Telematics and having the data to repair newer vehicles” – was named by 40% of the respondents, the third-biggest worry.

How does that compare to the last time we asked this question? We did not use the exact same list of worries in 2017, but 56% said they were worried about “Finding vehicle repair information” and 47% named “Difficulty of repairs due to vehicle design.” In third place was “Finding quality/trained technicians,” named by 44% as a worry.

Much farther down the list was “Complexity of repairs,” named by only 27% as a worry. So, it seems that in two years, the number of technicians worrying about vehicle complexity has more than doubled.

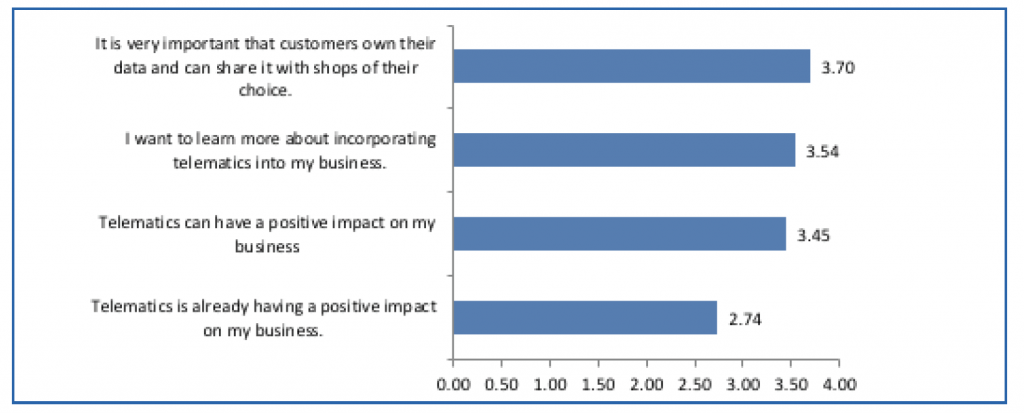

We asked some follow-up questions about telematics. We gave a number of statements about telematics and asked them how much they agreed (5) or disagreed (1) with the statements. The results are shown below.

Anything that scores more than a 3 shows more agreement than disagreement, while anything below 3 shows more disagreement. The only statement that the majority didn’t agree with was “Telematics is already having a positive impact on my business” at 2.74. However, there is hope for the future, as “Telematics can have a positive impact on my business” scored much better at 3.45.