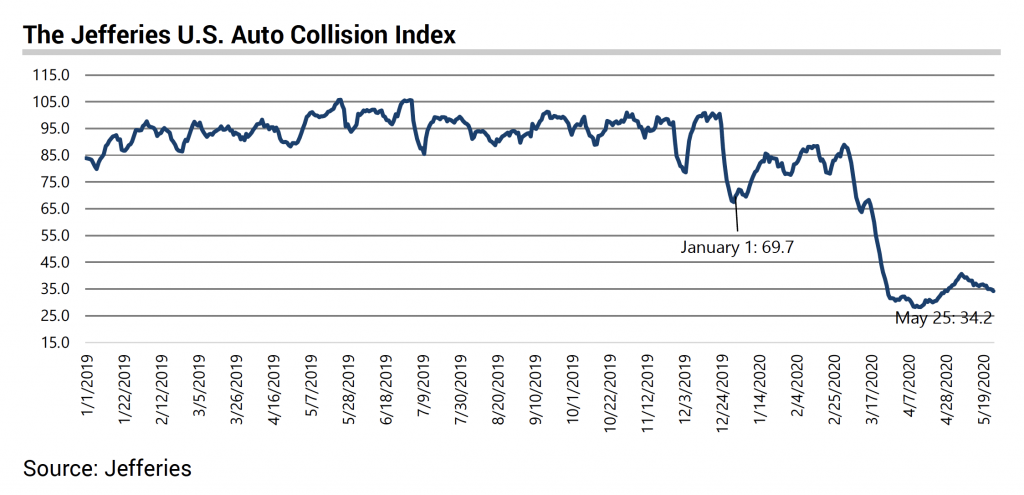

Jefferies has issued the latest numbers and analysis in its proprietary Jefferies U.S. Auto Collision Index.

The index, comprised of population-weighted accidents reported in major markets (through 5/25), provides insight to pending collision repair and salvage volumes as well as a read-through to longer-term driving related service demand.

The current Jefferies U.S. Auto Collision Index is 34.2 vs. 69.7 on 1/1 and 36.4 on 5/16. Jefferies analysts commented that they believe current mobility restrictions in major markets have skewed the index short-term.

Since Jan. 1, the Jefferies U.S. Auto Collision Index has fallen from 69.7 to 34.2. Since Jan. 1, the Jefferies U.S. Auto Collision Index has fallen from 69.7 to 34.2 as of May 25, and compares to 36.4 on 5/16. Jefferies stated, “We believe the current index skews below the national average given that major markets included in the index have implemented travel restrictions. However, we would expect less dispersion with the index moving forward as additional markets enter the index.”

The Jefferies U.S. Auto Collision Index uses a 7-day rolling average of motor vehicle collisions to determine current index levels and is indexed to the average daily collisions reported during calendar year 2018. Therefore, an index reading of 100 represents the average level of daily collisions recorded throughout 2018.