IMR Inc., a leading full-service automotive market research firm, has released the latest data on independent repair shop purchasing of private label/store brand parts.

In 2018, IMR Inc. asked shops if they had increased their purchasing of private label/store brand parts in the previous two years and 33.4% said yes. Now, 65.8% of shops report increased private label parts purchasing.

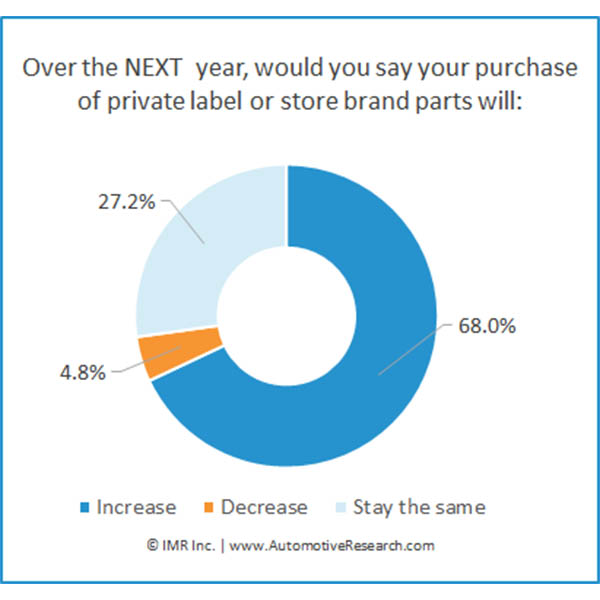

This trend is projected to continue over the next year, with 68.0% of independent shops now reporting that they plan to increase their purchasing of private label parts.

Only 1.0% of shop owners responded that they decreased their purchasing of private label/store brand parts over the last two years, while 65.8% increased their purchasing. Today, 45.4% of shop purchases are private label/store brand parts.

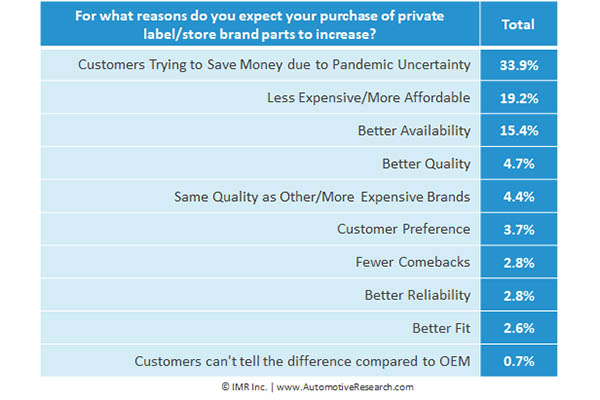

The COVID-19 pandemic has played a major role in this industry shift with independent repair shop owners stating that “customers trying to save money due to pandemic uncertainty” is the top reason for their increased purchasing (33.9%) of private label/store brand parts. This response was followed by cost-effectiveness (19.2%), better availability (15.4%) and better quality (4.7%) as additional reasons for increase.