The Heavy Duty Manufacturers Association (HDMA) has reported successful results for its seventh-annual Heavy Duty Aftermarket Dialogue (HDAD) Conference. The event saw a record attendance of more than 400 participants, who came together to engage in speaker and panelist discussions specifically directed toward the heavy-duty aftermarket supplier industry.

“The growth in the HDAD event is evidence of the value that it provides to our markets’ leadership,” said HDMA Chairman Tim Musgrave.

The conference featured 27 speakers including fleet executives, economic advisers, technology officers, sales and marketing leaders and maintenance directors. The dynamic mix of professionals and experts covered all facets of the heavy-duty aftermarket industry, as well as the state of the national and global economies. “We want to thank all of the panelists and speakers for their contributions, bringing together so many different perspectives for us,” said Musgrave.

The Real World View – A Global Perspective

HDAD opened with a panel discussion titled, “The Real World View – A Global Perspective” and included Ken Davis, founder of Greentree Advisors, LLC; Dean Engelage, president of Great Dane; Roger Nielsen, president & CEO of Daimler Trucks North America; and session leader Chris Patterson. These original equipment (OE) manufacturers provided insight into the relationship between OEs and the aftermarket regarding the investment of automation, electrification and traditional powertrains.

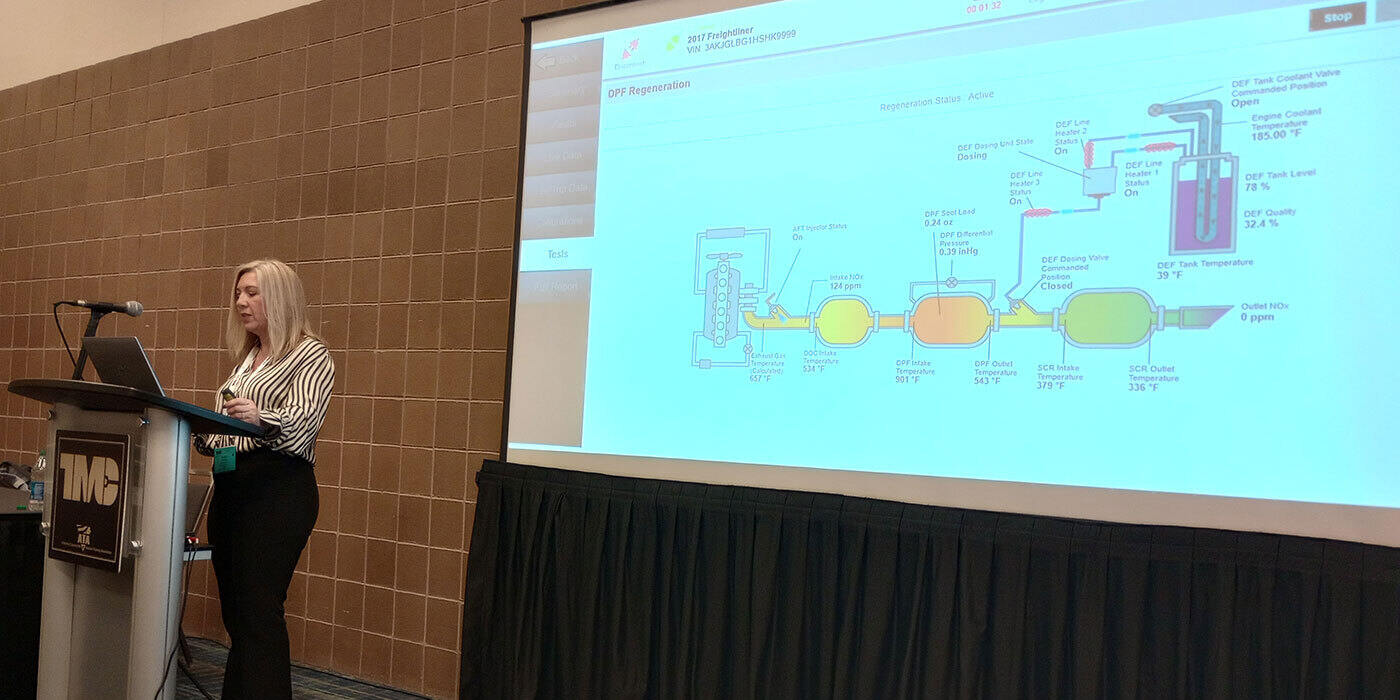

Telematics was a recurring topic at HDAD. “Trucks today have 400 sensors on them, 100 million lines of code and six SIM cards. It’s like having six cellphones on a vehicle,” said Nielsen. Use of telematics will increase, and companies will look to leverage that information to have parts available on demand.

“The vision we have is tying all the telematics and sensors into our aftermarket network to – with geofencing – alert the nearest location of the need for a particular part or service opportunity,” said Engelage. “We want to be able to predict when a failure is going to occur,” added Nielsen.

Regarding electrification, the panel noted it will have a significant impact on the current supply base. It will be the people who build mechanical drivetrains and parts versus those who build electric drivetrains only, according to Davis. The future of electric trucks will be found in specific markets and duty cycles, but only when the costs drop to a level with affordable equipment for fleets without the need for incentives, added Nielsen.

The Global Economic Overview

Bill Strauss, senior economist and economic adviser of the Chicago Federal Reserve, followed with “The Global Economic Overview,” moderated by Ann Wilson, senior vice president of government affairs for MEMA. In this session, Strauss said that the U.S. economy’s stability compares favorably to the rest of the world, as no country is “setting the world on fire.” After a 3 percent U.S. GDP growth in 2018, Strauss anticipates a continued 2 percent GDP growth through 2021. This coordinates with both Blue Chip and the Federal Open Market Committee (FOMC), who have the economy growing at or above trend through 2021.

Aftermarket Industry Economy and Outlook

John Blodgett, vice president, sales & marketing of MacKay & Co., and Dr. Bob Dieli, president & founder of RDBL Inc. spoke on the aftermarket industry economy and outlook. “We’ve seen a lot of changes in the past 10 years, including additions to vehicles, such as emissions, air disc brakes, automated manual transmissions and safety devices,” said Blodgett. The truck market is currently one of the hottest on record, with an estimated $4.1 billion aftermarket this year. This includes a 2.8 percent compound annual growth rate for the U.S. and a 4.4 percent compound annual growth rate for Canada, plus 1 percent and 3.7 percent growth rates, respectively, for parts pricing.

“We have now moved into what I call the boom phase,” said Dieli.

However, in 2019, Dieli said he has concerns about the investment, export, and import sectors, which will be influenced by supply chain issues, tariff and trade matters and regulations. Dieli believes these factors could put as much as 50 percent of Truckable Economic Activity (TEA) at risk. “For 2019, TEA looks to be challenging, but not necessarily bad,” said Dieli.

Realities of Current and Future Technology on the Aftermarket

The “Realities of Current and Future Technology on the Aftermarket” panelists expanded on topics that were introduced in the opening panel with regard to technological advances in the heavy-duty industry. Mike Foster, chief technology officer of Allison Transmission; Kent Jones, vice president of global business development and sales for ZF Group; Sandeep Kar, chief strategy officer of Fleet Complete; Jon Morrison, president Americas of WABCO; and session leader Brian Daugherty, chief technology officer of MEMA, made up the panel of subject matter experts.

Technology advancements that fleets are facing or will face include electrification, connectivity, telematics, cyber security, ADAS, automated driving, OTA software updates, alternative fuels and e-commerce.

Much of the discussion was focused on safety. “ADAS is great,” said Kar, “but what really protects the vehicle is braking and steering, so service and maintenance of these foundational technologies is important.”

Jones agreed, “The next level for active safety will be to control the truck with electrical steering. Thirty-two percent of accidents are from trucks leaving the lane.”

Regarding electrification, Kar believes that the truck market will continue to consist of a variety of powertrain options. Foster concurs, “It is going to be about how long the vehicle is in operation and how long you can have it down to charge. Fleets will have to ask themselves, ‘Can I still get the same amount of work done regardless of the powertrain?’”

Changing Distribution Model – The Growing and Emerging Players

The next panel, “Changing Distribution Model – The Growing and Emerging Players,” included Mike Harris, vice president of sales and branch operations for Fleet Pride; Stefan Kurschner, senior vice president of Daimler Trucks North America; Carl Mesker, vice president of sales Americas for SAF-HOLLAND; Walt Sherbourne, vice president of marketing for Dayton Parts; and session leader Lucas Deal, editor of Truck Parts & Service Magazine.

Discussions in the panel focused on how to remain competitive in the industry. “Studying other industries and learning how to use their knowledge will help them remain competitive,” said Mesker. Harris added that product assortment is key for independent distributors to maintain their advantage. “You have to be close to the customer and add value,” he said.

One hot topic was Amazon and other e-commerce sites that have recently surfaced. Kurschner said that, because of the e-commerce business model, everything is being structured around turning around trucks in 24 hours. However, “Amazon does not have the expertise at the counter,” said Sherbourne. “The channel that fulfills customers’ needs the best will win, and that changes day-to-day and market-to-market.”

Parts and Service: The Fleet Perspective

In the final HDAD panel of the day, Mike Palmer, vice president of fleet services for Estes Express Lines; Gloria Pliler, director of purchasing for Daseke; Lee Quinn, maintenance director of Point Ready Mix; Brett Wacker, vice president of maintenance for Dart Transit Co.; and session leader Stu MacKay of MacKay & Co. discussed “Parts and Service: The Fleet Perspective.”

Dealing with truck equipment that is increasingly more expensive and complex has fleet executives standardizing parts ordering and maintenance procedures as a result. “We have paid a price in terms of the complexity of the equipment and the cost of the components,” said Palmer. Complexity in the equipment has led to the need for continual training to ensure drivers understand the new technology and can operate all the unique trucks in a fleet. When it comes to parts ordering, Wacker says to look for availability, quality of the part, price and consistency of delivery.

On-site surveys concluded that attendees generally rated this year’s HDAD as an excellent event that they would likely recommend to peers. According to attendees, HDAD is valuable to their businesses, as the speakers and panelists provided honest, real-world perspectives and knowledge about the industry. The variety of topics ensured that all areas of the business were covered. Several attendees commented that they wished the discussions were longer.

HDAD was held from 8 a.m. to 4 p.m. on Monday, Jan. 28 at The Mirage in Las Vegas. The conference was co-presented by HDMA and MacKay & Co. and immediately preceded Heavy Duty Aftermarket Week (HDAW) 2019. HDAD was sponsored by American Diesel Training Centers, Fleet Maintenance, NEXIQ Technologies, and Pricedex Software.

The eighth-annual HDAD is scheduled to be held on Monday, Jan. 27, 2020, during HDAW 2020 at the Gaylord Texan Resort & Convention Center in Grapevine, Texas.