Tom Libby, loyalty principal, IHS Markit, has shared the following commentary on recent shifts in consumer vehicle preferences.

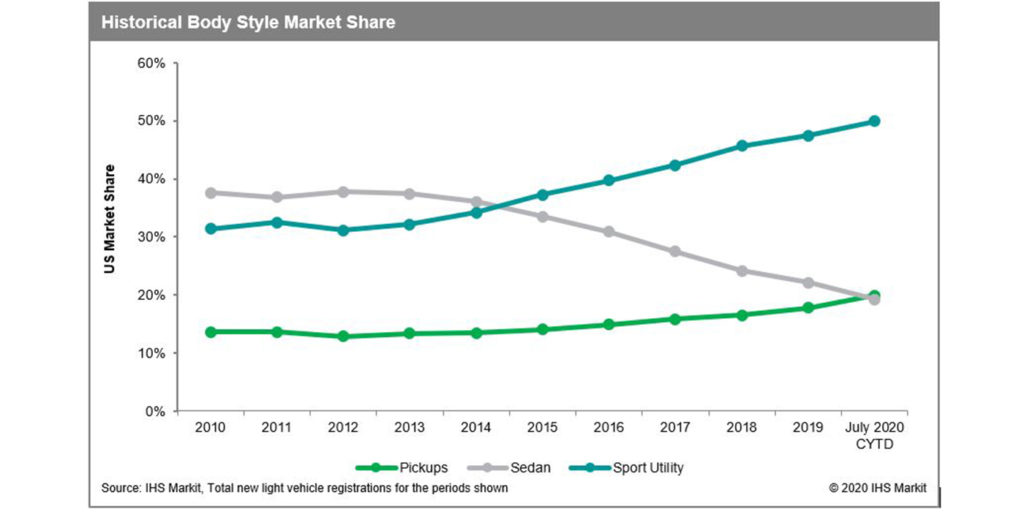

It’s well known that there’s been an ongoing shift in U.S. consumer preferences toward sport utility vehicles; however, what may not be as widely recognized is the magnitude of this change so far this year. A recent analysis of IHS Markit new vehicle registrations through July, 2020 (the most recent available) finds sport utilities account for 50% of all new vehicle registrations, up from 31% ten years ago (a 61% increase). If today’s mix continues for the remainder of 2020, it would mean not only that every other U.S. buyer is acquiring an SUV, but it also would mark the first time since 1987 that one body style has captured half of the U.S. new vehicle industry (IHS Markit data available for this analysis is only available through 1987).

This movement toward sport utilities is more acute in the luxury space where SUV share currently stands at 64%. Together with sedans (with a share of 27%), these two body styles account for 91% of all new luxury vehicle deliveries. The lack of pickups in the luxury space by default drives up the shares of other body styles.

Market share for mainstream pickups has also grown, driven in part by intense competition among the domestic manufacturers that dominate this space. Through July, pickups account for 19.9% of new vehicle registrations in the US, outpacing sedans for the first time in recent history. Half-ton full-size pickup share has grown from 8.8% in 2014 to 11.6% July 2020 CYTD, and three quarter/one-ton full-size pickup share has increased from 3.3% to 4.1% over the same timeframe.

Midsize pickups, which typically do not garner as much publicity as their larger stable mates, have experienced tremendous growth since 2014, with their share more than doubling from 1.5% to 4.2%. The recent re-entry of Ranger has increased interest in this category and provided another challenge to the ubiquitous Tacoma.

Sedans continue to lose ground. From their peak of 44.8% of the market in 1991, sedan share has plunged to just 19.2% through July, the lowest share for the segment since 1987.

With SUV/CUVs and pickups now accounting for more than two thirds of all U.S. new vehicle registrations, while some OEMs have made their move to align portfolios, the real question is if we start to see others follow suit as we also anticipate future trends including inevitable fragmentation within these categorie

Note: Data are based on IHS Markit total new light vehicle registrations, including analysis of data from our historic archives dating to 1987 and current insight from January 2010-July, 2020.