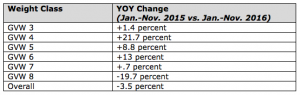

New registrations of Class 8 commercial vehicles in the U.S. declined 19.7 percent through November 2016, based on the latest analysis by business information provider IHS Markit. The decline among Class 8 vehicles contributed significantly to an overall drop of 3.5 percent for the full commercial vehicle market, despite all other GVW categories achieving year-over-year (YOY) growth through November. Within Class 8, the decline was greatest in tractors, down 27.8 percent, with straight trucks improving 2.9 percent in the 11-month timeframe. An overview of the various weight classes and their respective YOY change are as follows:

New registrations of Class 8 commercial vehicles in the U.S. declined 19.7 percent through November 2016, based on the latest analysis by business information provider IHS Markit. The decline among Class 8 vehicles contributed significantly to an overall drop of 3.5 percent for the full commercial vehicle market, despite all other GVW categories achieving year-over-year (YOY) growth through November. Within Class 8, the decline was greatest in tractors, down 27.8 percent, with straight trucks improving 2.9 percent in the 11-month timeframe. An overview of the various weight classes and their respective YOY change are as follows:

“The market for commercial vehicles in GVWs 3-8 has performed in line with IHS Markit expectations during the 2016 calendar year,” said Gary Meteer, director, commercial vehicle solutions for IHS Markit. “The decline in GVW 8 new registrations by large (501-plus) fleets was first identified during the middle of the 2015 calendar year and the subsequent decline continued throughout the 2016 calendar year.

“These large fleets accounted for less than 40 percent of new GVW 8 registrations prior to the 2008 calendar year and reached a peak of over 50 percent during the 2011 calendar year,” said Meteer. “The recovery in GVW 8 new registrations will need renewed activity by these large fleets if the annual volume is to remain in the 225,000 to 250,000 unit range annually.”

Leading brands

From a brand leadership perspective, Ford remains the top-selling brand in the commercial vehicle market, with new registrations up 10 percent YOY for the timeframe as a result of its strong penetration in a few classes: GVW 3 (45.2 percent share), GVW 4 (60.5 percent share) and GVW 5 (67.9 percent share). In GVW 8, Freightliner remains the segment leader, with 34.4 percent share, followed by Kenworth (14.9 percent share) and Peterbilt (13.9 percent share).

Regional analysis shows mix of growth and decline

When dissecting the data by U.S. region, some trends are clear according to the data from IHS Markit. The West and Northeast U.S. achieved modest growth through November 2016, leading with 6.8 percent in the West and 6.1 percent in the Northeast. Conversely, the South and Central regions of the country experienced declines, with the South being 4.3 percent down year over year and the Central region of the country experiencing a 15 percent decline.

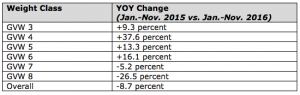

Large fleet registrations declined overall, but GVWs varied significantly

The IHS Markit analysis found that new commercial vehicle registrations among large fleets (those with 501-plus units) were down 8.7 percent compared to the same 11-month time frame in 2015, yet the variances between growth and decline when looking at the various GVW classes are significant. A full view of the market changes by GVW among large fleets is as follows:

2017 sales expected to be neutral to slightly up

IHS Markit forecasts that 2017 will be a year of stabilization for the U.S. truck market, with the first quarter of the year still showing year-on-year lower sales figures. An increase in the key trucking markets is expected to occur in the second and particularly third quarter onward. The aggregate Class 4-8 truck sales (excluding bus and motor home) should settle in the range of roughly 400,000 for the full year, virtually flat from 2016. Class 8 will likely give back an additional 10,000 sales from last year, while the Class 4-7 medium-duty sector is expected to show gains in most weight classes, thus offsetting the heavy-duty softness of early 2017.

IHS Markit experts are attending Heavy Duty Aftermarket Week in Las Vegas this week. Demonstrations of IHS Markit solutions for the commercial vehicle industry and aftermarket will be available in the IHS Markit exhibit, booth 1015.