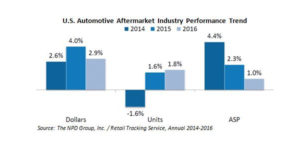

The U.S. automotive aftermarket industry reached $15 billion in retail sales in 2016, growing 2.9 percent over the previous year, according to global information company The NPD Group. While dollar growth slowed, unit/quart growth accelerated, which correlates closely to the decline in overall average selling price. Macro trends, including an increase in miles driven and new car sales, lower-priced gasoline and unpredictable weather patterns, impacted the industry’s annual performance.

The U.S. automotive aftermarket industry reached $15 billion in retail sales in 2016, growing 2.9 percent over the previous year, according to global information company The NPD Group. While dollar growth slowed, unit/quart growth accelerated, which correlates closely to the decline in overall average selling price. Macro trends, including an increase in miles driven and new car sales, lower-priced gasoline and unpredictable weather patterns, impacted the industry’s annual performance.

“Declining retail prices driven by a push for private-label along with an increase in deeper promotions is behind this dollar/unit retail dichotomy. Though the dollar sales growth rate has slowed, a number of factors helped the industry to stay on the plus side in 2016,” said Nathan Shipley, director and automotive industry analyst, The NPD Group. “Overall, 2016 had the lowest gasoline prices on record out of the past five years, inspiring consumers to drive more. In addition, new car sales in 2016 unexpectedly set a record by outperforming 2015, benefiting categories such as appearance chemicals and accessories as consumers look to accessorize and maintain that new car appearance.”

Category Performance

Looking at the largest aftermarket categories tracked, batteries ended the year as the top-performing category despite a decline in average selling price, with a 7 percent increase in dollar sales. The unit share of “good” grade batteries grew more than four percentage points in 2016 as consumers, incentivized by lower price points, chose to trade down from more premium options. Motor oil sales grew 1 percent in both dollars and quarts in spite of a 14 percent increase in promotion count, deeper promotions and strong performance for private-label. Dollar sales of wipers grew by 1 percent, and while beam blades continue to steal share from conventional, the premium segment within beam lost share to standard beam blades – a less expensive alternative for consumers.

A December to Remember

Sales in the automotive aftermarket spiked in December 2016, with monthly growth three times the annual result, or 9 percent. Given that December 2016 was much colder compared to 2015 (the hottest December on record), this caused the peak in sales, illustrating how one month of bad weather can alter the results of an entire calendar year. The top-performing categories for the month were all cold weather-related.

The Year Ahead

The year began with dollar sales down 1.4 percent, according to the report, as January 2017 was the 18th warmest and 8th wettest January on record. Contrary to the cold weather categories that grew in December, a number of other categories benefited from the warm and rainy weather this January, demonstrating the influence of inconsistent weather patterns on both annual and monthly performance.

Assuming retail pricing moves similar to 2016, and taking into account the latest trends in miles driven and gasoline prices, NPD forecasts that aftermarket dollar sales will decline 1.9 percent in 2017. Some categories will outperform the forecast, which is dependent on how the weather fares and how quickly, as well as by how much, gasoline prices increase this year.

“Declining retail prices coupled with a slowdown in miles driven in recent months point to a decline in retail dollar sales in 2017. I expect that miles driven growth will slow due, in part, to higher gasoline prices, which were 20 percent higher in the first four weeks of 2017 than the same period last year,” said Shipley. “As always, extreme weather events are impossible to foresee, but help the industry to grow.”