CANTON, Ohio – The Timken Co. has reported sales of $1.1 billion for the second quarter of 2013, a decrease of 16 percent from the prior year. The company said this decline primarily reflects lower off-highway, industrial distribution and oil and gas demand as well as the impact of the company’s market strategy in the light-vehicle sector, partially offset by the benefit of acquisitions. In addition, sales reflect a $49 million decline in raw material surcharges from the prior-year quarter.

Timken generated net income in the second quarter of $82.8 million, or 86 cents per diluted share. This compared with $183.6 million, or $1.86 per diluted share, during the same period a year ago, which included income of $69 million, or 70 cent per share, from Continued Dumping and Subsidy Offset Act (CDSOA) receipts. The company said the decrease in second quarter earnings also reflects lower demand as well as unfavorable sales mix. The decrease was partially offset by lower raw material costs (net of surcharges) and selling and administrative expenses as well as lower costs related to previously announced plant closures.

"We continue to perform very well, maintaining double-digit operating margins despite weak demand lingering in many global markets," said James Griffith, Timken president and CEO. "Although our outlook for the year now reflects a more modest market recovery in the second half, we continue to expect strong financial performance for the remainder of the year."

Timken posted sales of $2.2 billion in the first half of 2013, down 20 percent from the same period in 2012. The decrease reflects lower off-highway, industrial distribution and oil and gas demand as well as the impact of the company’s market strategy in the light-vehicle sector, partially offset by acquisitions. In addition, a $121 million decline in raw material surcharges from the prior-year period negatively impacted first-half revenues.

In the first half of 2013, the company generated net income of $157.9 million, or $1.63 per diluted share. That compares with $339.3 million, or $3.44 per diluted share, in the same period last year, which included CDSOA receipts of $69 million, or 70 cents per share. The decrease in earnings during the first half of 2013 was driven by lower demand, sales mix and higher manufacturing costs, partially offset by improved pricing and lower selling and administrative expenses as well as lower costs related to previously announced plant closures.

As of June 30, 2013, total debt was $462.5 million, or 16.6 percent of capital. The company had cash of $396.8 million, resulting in $65.7 million of net debt, compared with a net cash position of $107.4 million as of Dec. 31, 2012.

Outlook

The company revised its outlook for the full year based on a slower-than-expected economic recovery in the second half of 2013. The Timken Company now expects 2013 sales to be 10 percent lower year-over-year with:

* Mobile Industries sales down 7 to 12 percent for the year due to the impact of lower customer demand and the company’s market strategy;

* Process Industries sales to be down 2 to 7 percent, due to weaker industrial markets, partially offset by the benefit of acquisitions;

* Aerospace sales up 3 to 8 percent, due to increased demand in civil and defense markets; and

* Steel sales down 15 to 20 percent, driven by lower industrial and oil and gas end-market demand and surcharges.

Timken projects 2013 annual earnings per diluted share to range from $3.30 to $3.60, which includes approximately 15 cents per share for previously announced plant closure costs. The company expects to generate cash from operations of approximately $475 million in 2013. Free cash flow is projected to be $25 million after making capital expenditures of about $360 million and paying about $90 million in dividends. The company does not anticipate making further discretionary pension contributions this year beyond the $66 million, net of tax, made in the first quarter, as it expects its pension plans to be essentially fully funded by year end given the recent increase in interest rates. Excluding discretionary pension contributions, the company forecasts free cash flow of approximately $90 million in 2013.

MAHLE Awarded Thermal Management Module Contracts

The total order volume across both projects is just under €1.5 billion.

MAHLE announced it secured two major orders for thermal management modules and said it is successfully continuing its course of acquisition in the field of e-mobility. One of the contracts is from an established, globally-present vehicle manufacturer, according to MAHLE. It marks the largest single order in the company history of the technology group.

Dill Air Controls Acquires Exactra, Inc.

“The expertise and equipment from Exactra’s many years of experience in the industry are critical to our continued growth,” said Brian Rigney, Dill president.

Philips Announces Xperion 6000 LED Under Hood Work Light

It features a motion detection switch that allows mechanics to turn the light on and off with a wave of their hand.

Stoneridge Releases Inaugural Sustainability Report

The report highlights the company’s progress on Environmental, Social and Governance initiatives.

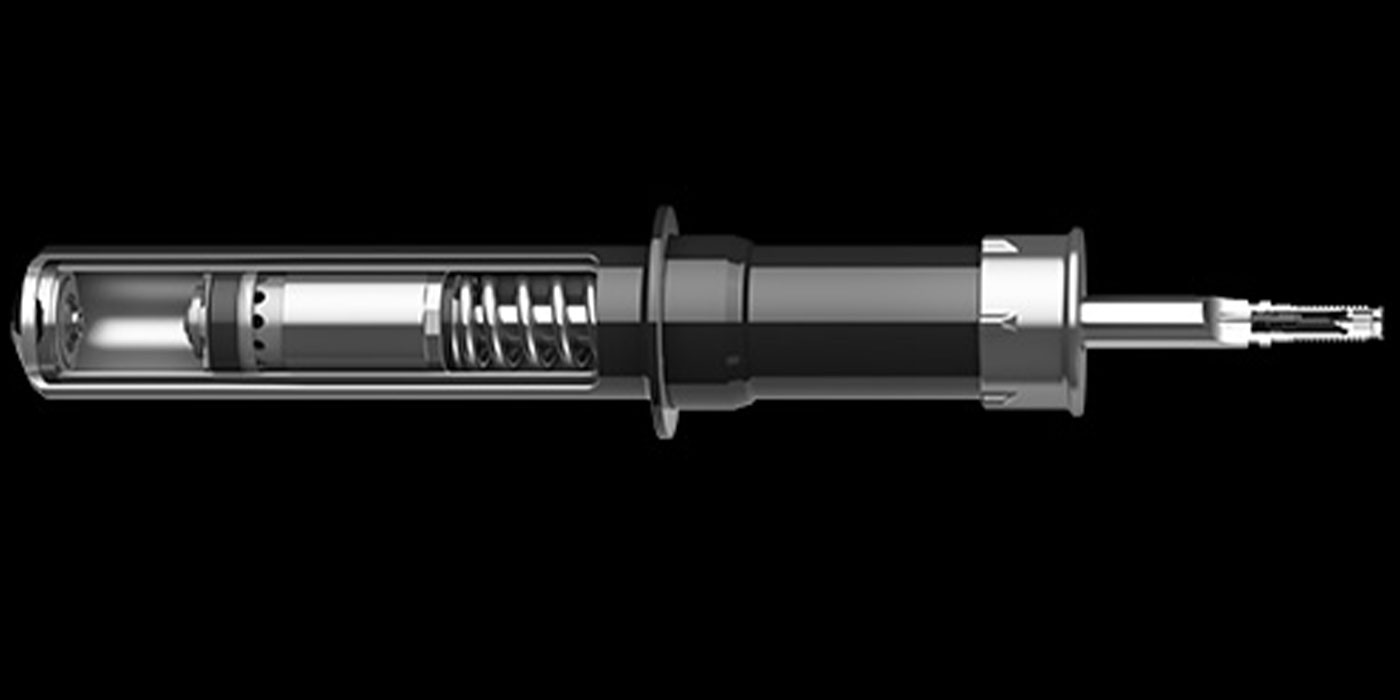

ZF Expands SACHS CDC Shock Line for U.S., Canada

The release expands ZF’s line by more than 70 percent, reflecting growing demand for advanced damping technology in the aftermarket.

Other Posts

Clarios to Supply High-Performance AGM Battery to Major OEM

It offers up to 80% reduction in CO2 emissions over traditional AGM batteries, in many cases, Clarios said.

Continental Tire Opens Retread Solutions Center in South Carolina

The company said it hopes to uncover new improvements and technologies to innovate the retread process.

Philips Announces GoPure GP5212 Automotive Air Purifier

It uses a 3-layer filter to deliver cleaner, healthier, fresher air on the go, Lumileds said.

Akebono Introduces Severe-Duty Ultra-Premium Fleet Brake Pads

The brake pads are engineered to endure challenging conditions, delivering exceptional stopping power when it matters most, Akebono said.