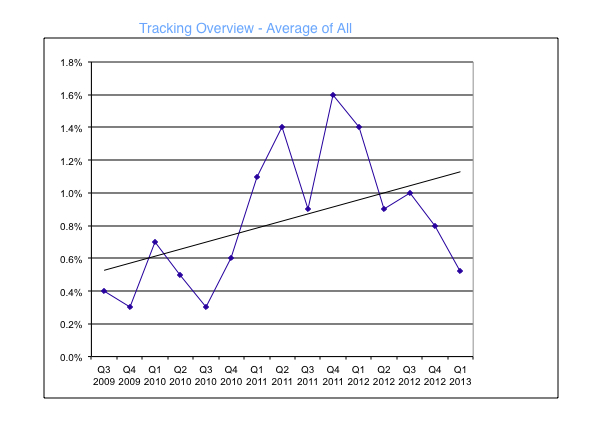

For this week’s edition of "The Pulse," TLG Research looks at quarter-to-quarter changes in aftermarket price analysis. In general, the market remains fairly flat, with growth in some catastrophic repair categories due to owners deferring all but critical work and, in many cases, neglecting maintenance. The reasons driving this remain somewhat the same as 2012, TLG says.

1. While unemployment was reported to drop a bit, the recent jobs report, the weakest in many years at 88,000 in March, suggests that there is little real expansion. Moreover, the rate is helped by people who have either become "discouraged," or dropped out of the job search, so are no longer counted. And, of the recent jobs report, more than 7.5 million are working part-time who were let go or desire full-time, the civilian workforce actually fell by 496,000 in March. None of this bodes well to strengthen the buying public.

2. The bright spot has been new car sales. Some have explained them as a result of recent pent-up demand after three soft years. Others report that replacement became the only option to deal with their current vehicle. Still others suggest that it is a combination of high residual vales, and as a result, aggressive leasing.

3. Uncertain tax policies and ramifications, new penalties, health programs and more have led to many businesses and people pulling in stockpiling cash.

There are opposite forces currently working for and against price increases. On one hand, many feel they need to take their increases now before inflationary pressure sets in so there’s not a last minute large hit. At the same time, tepid demand and economic forces are working against price increases. This is especially true in the face of core GPD areas such as food and fuel prices increasing at a strong rate.

In the tug of war, price increases are no doubt on the way as fear of inflation and desire to drive profits while it’s possible to bank towards any future softness in the economy.

Definitions:

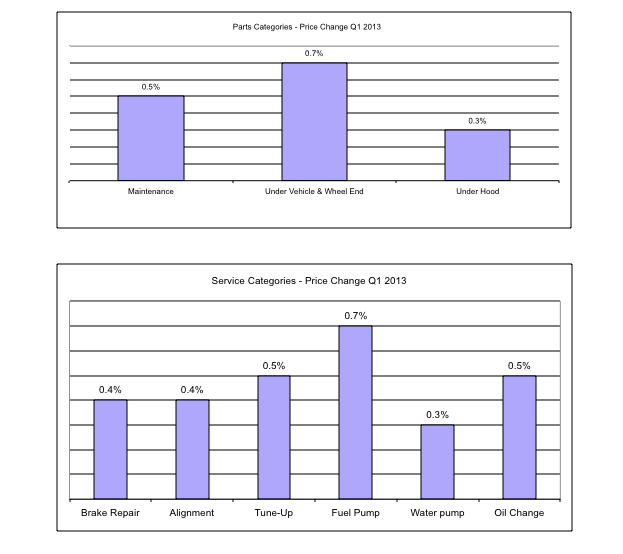

Parts Category

1. Based on reported pricing of parts to service repair centers

2. Represents change of current quarter over the prior quarter

Service Category

1. Represents total job repair order price to prior quarter

Methodology for Pricing Calculations:

The pricing is based on changes in the current quarter relative to the prior quarter. The data is collected from service repair centers with additional service repair center level pricing information provided by Nu-Way Automotive. The "Parts Categories" includes only the parts. The "Service Categories" include both parts and labor and is based on the average reported. Pricing is collected in percent change, and is averaged across the U.S. Where needed, the data is weighted in order to represent the entire market.

About TLG Research

Focused exclusively on all segments of the global automotive industry, TLG Research (TLGR) offers clients a unique approach to obtaining and keeping a global competitive advantage. Recognized as the “Parts Problem Solvers,” TLGR provides information quickly and cost effectively. Founded in 1992 by Thomas Langer, a 30-year industry veteran, TLGR, through its proprietary database, provides a unique "menu driven" approach to offer services such as price comparisons and strategies, product/market data, channel information, competitive analysis, surveys, new product strategies and technical writing.