Each week, The Pulse provides insight into the buying, sourcing and brand-loyalty habits of counter professionals and professional technicians. This week, using data from Industrial Marketing Research’s (IMR) recent Installer Survey, we look at technician sourcing habits for import parts.

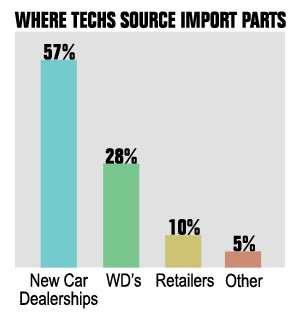

When it comes to import parts, new car dealerships are the leading source, according to IMR data. Combined, the majority (57 percent) of the various types of repair shops surveyed by IMR chose new car dealerships as their first call for import parts. The next most common source is the wholesale distributor (28 percent), followed by retailers (10 percent) and “other” sources (5 percent). “Other” sources include salvage yards, Internet sites and direct from the manufacturer.

Broken down by category, the IMR Installer Survey looks the sourcing habits of technicians working in general repair shops, ‘specialist’ shops (including muffler, transmission and engine shops), collision repair shops, tire dealers, quick lube facilities, gasoline service stations and new car dealerships. Collision repair shops were the shops that most frequently look to new car dealerships for import parts — nearly 80 percent of the time. Gasoline service stations and engine rebuilders followed closely behind with 49 percent and 51 percent of the votes, respectively. General repairs shops call on new car dealerships for import parts about 40 percent of the time.

For more information on IMR and its research capabilities, visit IMR at http://www.industrialmr.com or call 800-654-1079.