Standard Motor Products Inc. (SMP) has reported its consolidated financial results for the three months and nine months ending Sept. 30, 2017.

Standard Motor Products Inc. (SMP) has reported its consolidated financial results for the three months and nine months ending Sept. 30, 2017.

Consolidated net sales for the third quarter of 2017 were $281.1 million, compared to consolidated net sales of $300.8 million during the comparable quarter in 2016.

Consolidated net sales for the nine month period ended Sept. 30, 2017, were $876.2 million, compared to consolidated net sales of $828.7 million during the comparable period in 2016.

Loss from discontinued operations, net of income taxes, in the third quarter of 2017 was $4 million compared to $425 thousand in the comparable period last year. The discontinued operation relates to asbestos-related indemnity claims and legal expenses from a brake business divested in 1998. Annually, in the third quarter, the company engages an independent actuary to assess the company’s asbestos-related liability exposure. SMP says the actuary has estimated that the company’s gross undiscounted potential exposure for indemnity claims from September 2017 through 2060 will range from $35.2 million to $54 million, and legal expenses will range from $44.3 million to $79.6 million. In the third quarter of 2017, the company recorded a non-cash $6 million provision, $3.6 million net of taxes, to increase the asbestos-related indemnity liability to $35.2 million. Legal expenses are expensed as incurred.

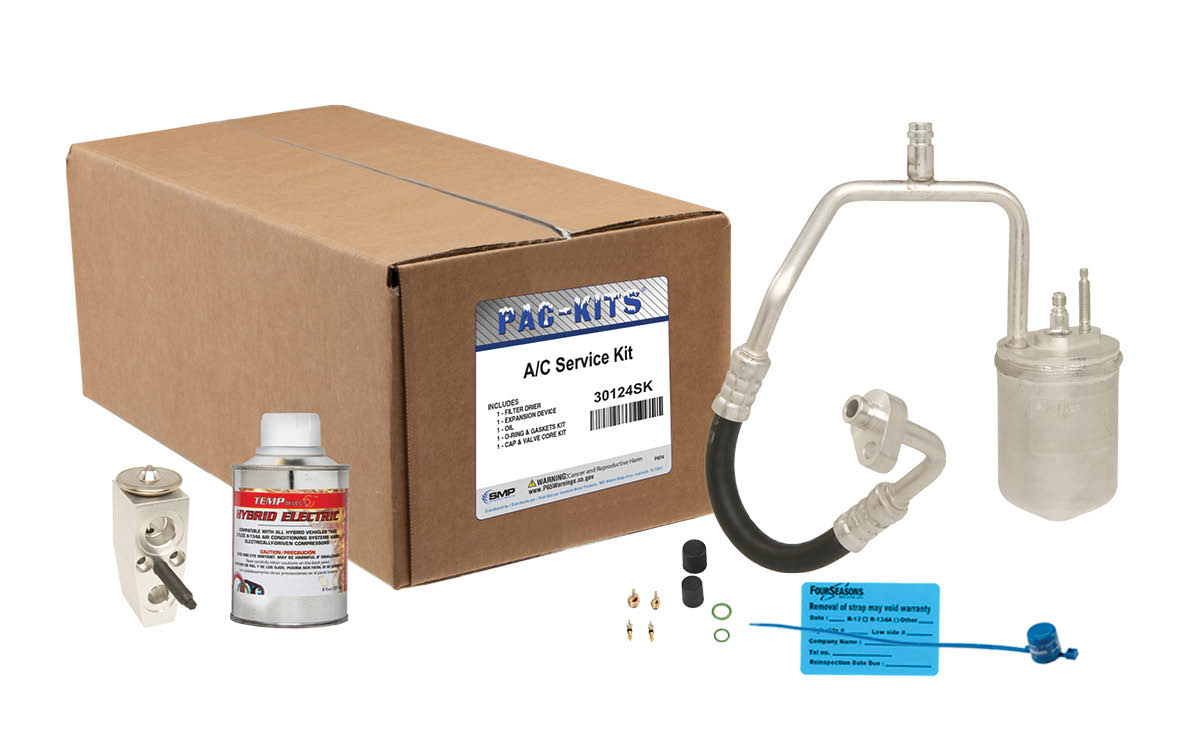

Eric Sills, Standard Motor Products’ CEO and president, stated, “There were two basic reasons for the shortfall in sales and profits in the third quarter, both of which are short-term in nature. First was the decline in Temperature Control sales, which was the result of a cool summer following a very warm 2016; second was a reduction in Engine Management gross margin, which was largely due to the temporary costs of plant moves, which, when complete, will make us a much stronger company.

“First, Temperature Control sales. 2016, you will recall, was a very warm summer, and our customers reported sales increases in our line of 9 percent. As a result, their pre-season orders this year were very strong, and our first half Temperature Control sales were up 9 percent.

“2017 has proven to be a cool summer, and our customers have focused on reducing their Temperature Control inventories during the third quarter. Our sales were down 16 percent in the third quarter, but year-to-date they are down only 1 percent. This is still slightly better than our customers’ reported year-to-date sales decrease of 5 percent, and as a result we are anticipating a potential further decline in their purchases in the fourth quarter, as they continue to bring their inventories into line.

“However, despite the decline in sales, we were able to improve Temperature Control gross margin to 26.8 percent in the third quarter and 26.2 percent year-to-date, both ahead of 2016 figures. This is primarily the result of the relocation of production from Grapevine, Texas, to our low-cost plant in Reynosa, Mexico, which will be complete by the end of 2017, and continuous improvement in our joint venture in Foshan, China.

“Our Engine Management sales decreased in the third quarter by 2 percent as compared to 2016. Year-to-date, Engine Management sales are up 8.8 percent; however, adjusting for the General Cable ignition wire business, acquired in May of 2016, our year-to-date Engine Management sales are ahead of the prior year by 2.2 percent. This increase is within our stated expectations of low single-digit organic growth.

“Our Engine Management gross margins continue to be impacted by the multiple facility moves that began in 2016. Two moves – ignition coils from Greenville, South Carolina, to Poland, and diesel products from Grapevine, Texas, to Greenville – are physically complete, with the receiving locations doing well but still working toward achieving run-rate efficiencies.

“Two moves are still underway. The largest is the consolidation of the General Cable wire assembly operation from Nogales, Mexico, to Reynosa, a move involving 500 people. We have also begun the relocation of our electronics plant in Orlando, Florida, to our Independence, Kansas, facility. These moves are on-schedule and due to be complete by mid-2018. Until then, as we have discussed, we are incurring substantial temporary costs relating to ramp-up inefficiencies, duplication of overhead, and the hiring and training of hundreds of employees. These costs, temporary in nature, are the primary reason for the decline in Engine Management gross margin.

“These moves have been a major effort for our company, involving many of our locations and many of our people. When complete, they will result in the closing of three facilities – Grapevine, Texas; Orlando, Florida; and Nogales, Mexico. Once the receiving locations achieve run-rate efficiencies, we anticipate annualized corporate-wide savings of $16 million to $18 million from today’s costs.

“During the third quarter, despite the drop in volume, we were able to reduce SG&A expenses nearly a full point, from 20.4 percent to 19.5 percent. A major component was the integration of General Cable distribution and sales function into SMP as well as overall management of controllable costs and reduced incentive compensation expenses.

“In conclusion, while we are not satisfied with our third quarter results, we believe that the causes are relatively short-term in nature, and that the steps we have taken will lead to substantial improvements in future years. We wish to thank all our employees as we strive to deliver our value proposition to our customers as the best full-line, full service supplier of premium Engine Management and Temperature Control Products.”

SMP’s board of directors has approved payment of a quarterly dividend of 19 cents per share on the common stock outstanding. The dividend will be paid on Dec. 1, 2017 to stockholders of record on Nov. 15, 2017.