Ford, General Motors, FCA US and Nissan collectively would have earned $2 billion more in operating profit last year had their supplier relations improved as much as Toyota and Honda did during the year.

Ford, General Motors, FCA US and Nissan collectively would have earned $2 billion more in operating profit last year had their supplier relations improved as much as Toyota and Honda did during the year.

That’s one of the conclusions from the 15th annual North American Automotive – Tier 1 Supplier Working Relations Index Study. The study looks at the automakers’ supplier relations and how they impact OEM profits. This year, 435 suppliers participated.

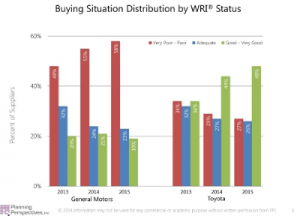

Results of this year’s study show Toyota and Honda clearly on top and continuing to distance themselves from Ford, Nissan, FCA and GM.

The study is watched carefully in automakers’ boardrooms because an OEM’s supplier relations rating is highly correlated to the benefits that a supplier chooses to give an OEM – including which OEM is first to see a supplier’s newest technology, is provided a supplier’s best personnel for support, and gets their best pricing – all of which impacts an OEM’s competitiveness and operating profit.

“Last year we unveiled an economic model that proves a direct cause-effect relationship between an automotive OEM’s supplier relations and the OEM’s operating profit,” said the study’s author, John Henke Jr., Ph.D., president and CEO of Planning Perspectives Inc., Birmingham, Michigan. “For the first time ever, it allowed us to put a dollar value on suppliers’ non-price benefits – those valuable actions and practices, which along with supplier price concessions make a substantial contribution to an OEM’s competitiveness. The economic model enables us to determine the economic value of the non-price benefits and the supplier price concessions, which in turn enables us to calculate the supplier total economic contribution to the operating profit of each OEM.

“This year, Toyota and Honda improved their WRI ranking a combined average of 8.7 percent over last year’s levels. Using our economic model, we know that if supplier relations at Ford, Nissan, FCA and GM also improved by 8.7 percent, they each would have realized significantly higher operating income – an estimated $2.02 billion collectively. At the low end, Nissan would have generated another $261 million and at the high end GM would have earned another $750 million, with Ford and FCA in between.”

Why are Toyota and Honda so far ahead?

One word can explain the difference in supplier relations between Toyota and Honda and the other four automakers, said Henke: Commitment. The two top-ranked automakers take supplier relations very seriously and actively work at it throughout their respective organizations, but particularly within their purchasing organizations, Henke said. This includes the vice president of purchasing down to the buyers who work with the suppliers on a daily basis. They are executing the basics better than the other four automakers. He said that while supplier relations has many complexities, the issues involved are quite straightforward and the resulting OEM benefits are more than worth the effort to improve.

So what’s not working for the Detroit Three and Nissan?

The question also remains, what’s wrong with GM, Ford, FCA and Nissan? Henke thinks there are three potential factors involved. First, their supplier relations programs are not focused on a sufficient number of the foundational or relational activities that can make a difference in supplier relations. Second, the buyers and engineers responsible for implementing the necessary improvements are simply not capable of doing so, or more likely are not sufficiently motivated do so. And third, when internal mandates come down to reduce cost, buyers are simply reverting back to their old adversarial ways of getting the reductions, because for them building collaborative supplier relations is of little importance.

“OEM buyers and management have to remember that cost reductions, contract changes and other similar programs do not of themselves result in poor supplier relations; it’s the manner in which these programs are administered that causes poor relations with suppliers,” said Henke.