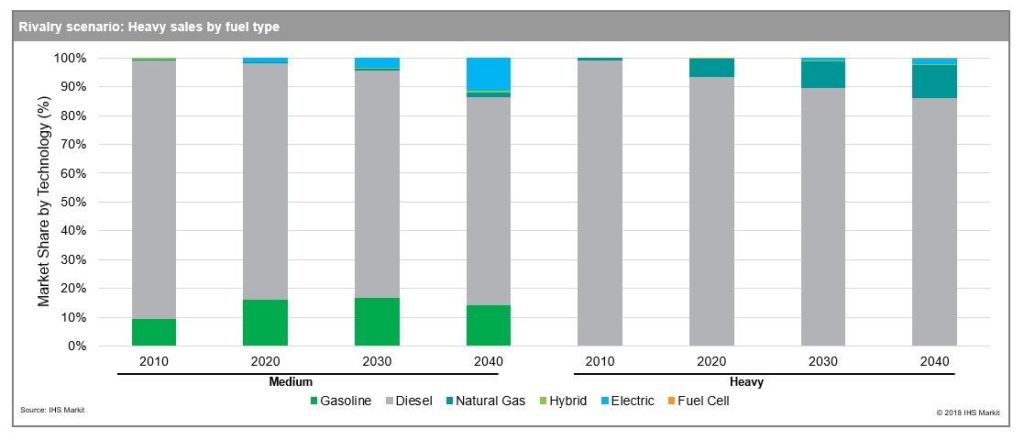

Commercial vehicles will continue to run on diesel fuel for the foreseeable future, according to new research from business information provider IHS Markit. Sixty-six percent of new medium and heavy commercial vehicles sold in the U.S. will be fueled by diesel (diesel and diesel hybrid) in 2040, compared to nearly 80 percent today, per findings released today from the IHS Markit multiclient study, “Reinventing the Truck.” The study was completed between January and July of 2018 and includes research from the automotive, economics and country risk, energy and chemicals teams at IHS Markit.

Commercial vehicles will continue to run on diesel fuel for the foreseeable future, according to new research from business information provider IHS Markit. Sixty-six percent of new medium and heavy commercial vehicles sold in the U.S. will be fueled by diesel (diesel and diesel hybrid) in 2040, compared to nearly 80 percent today, per findings released today from the IHS Markit multiclient study, “Reinventing the Truck.” The study was completed between January and July of 2018 and includes research from the automotive, economics and country risk, energy and chemicals teams at IHS Markit.

Reinventing the Truck is a major multi-client research initiative that provides a first-of-its-kind, system-wide analysis of the new reality of transportation and the potential implications for the oil, gas, automotive, electric power and chemical industries. Reinventing the Truck focuses on the world’s largest trucking markets – the United States, Europe and China, as well as Japan – with projections out to the year 2040. Forthcoming research will assess the specific impacts, investment implications and strategic choices for the automotive, oil, gas, electric power and chemical industries.

The firm says diesel is expected to remain the dominant fuel type globally through 2040 due to increases in fuel economy, which will play a major role in keeping diesel competitive versus alternative powertrains, the study says. Range and load capacity requirements from long-haul, on-highway trucking will keep diesel relevant in the short- and long-term, while other propulsion types will grow in popularity as technology continues to advance.

“Understanding the future course of commercial trucking is so important because its impacts will reverberate far beyond just the trucking industry and through a whole host of industries,” said Daniel Evans, vice president of the IHS Markit downstream practice and co-author of the study. “Trucking accounts for half of diesel demand globally, or one-sixth of oil demand, making the future of trucking critically important for the oil industry. A wholistic, system-wide view is needed to see the full picture of this new reality of transportation.”

While diesel does remain dominant, the IHS report and forecast indicate a 15 percent compound annual growth rate (CAGR) for battery electric vehicles in the U.S. during the timeframe, as adoption rates increase in medium-duty trucks. IHS says this growth is driven from an increase in urban trucking ton-km and advancements in battery technology allowing for more mainstream adoption – particularly among class 4 and 5 trucks with lighter payloads.

The study also highlights a view on total cost of ownership (TCO), with modeling suggesting BEV struggles in competitiveness compared to diesel and natural gas (CNG and LNG). In addition, the weight requirements of the battery pack cause limitations on the hauling capacity of the truck. Currently, to achieve equivalent range compared to a diesel Class 8 truck the subsequent battery pack weight required would result in a large cargo capacity penalty, according to IHS’s research.

Due to the initial cost disadvantage of these alternative powertrains, larger truck fleets will be the first to adopt alternative powertrain technologies. Smaller fleets and owner-operators encompass a large share of the market, leading to the slower adoption curve seen in the study. Also, larger fleets will have the capacity to implement a diversified fleet in a more strategic manner, allowing for alternative propulsion options to be implemented in areas that maximize their fuel-saving benefits and minimize the range and payload penalty.

“The regulatory environment will have a large impact on the pace of change in the industry between now and 2040,” said Matt Trentacosta, automotive advisory consultant for IHS Markit and a co-author of the study. “A diesel ban within city centers has the potential to cause fleet owners to adjust their strategy alongside OEMs and suppliers,” he said. “In addition, trucking impacts energy consumption and any dramatic change could elicit a major disruption in the energy markets.”

In the study, IHS Markit also considers a future with a more stringent regulatory environment in its “Autonomy” scenario, which takes a more aggressive approach from regulators to shift away from fossil fuels. The impact from regulations banning diesel options inside of city centers creates a scenario with a much more rapid adoption of BEV, hybrid and fuel cell trucks. European markets will experience faster adoption of alternatives in this scenario.

IHS says Overall sales of medium- and heavy-duty trucks in China will begin to taper in 2040 in both scenarios as the industry becomes more organized and mature. Adoption rates of alternative powertrains start a bit slower than the rest of the RTT regions (Japan, U.S. and EU), but grow quickly as the technology is proven.

Trentacosta will discuss findings from Reinventing the Truck during the upcoming IAA Commercial Vehicles show in Hannover, Germany. IHS Markit automotive experts will be available to discuss further details from the report during the conference.