MOUNTAIN VIEW, Calif. — North America is rapidly laying claim to the top slot in the manufacture of medium- to heavy-duty hybrid and electric commercial vehicles (CVs). This position of strength offers its domestic original equipment manufacturers (OEMs) and suppliers the unique opportunity to not only benefit from the local market’s growth, but also cement leadership positions in South America and Asia. In 2020, approximately 307,000 medium- to heavy-duty hybrid and electric trucks and buses will be manufactured globally, nearly half of which will be produced in North America.

New analysis from Frost & Sullivan, Strategic Analysis of the Medium- to Heavy-duty Hybrid and Electric Commercial Vehicle Market in North and South America, estimates that nearly 7 percent of all medium/heavy commercial vehicles manufactured globally in 2020 will have hybrid/electric powertrain systems.

While North America will be the leader of the pack in the global markets, Brazil and other South American markets are gradually picking up steam. OEMs and suppliers are working both independently and collaboratively to spur this rapidly evolving market. They are developing innovative products, technologies, and supply chains to help reduce both upfront and lifecycle costs associated with these vehicles, which are perceived by many as prohibitive.

Further, hybrid/electrics can be upstaged by nascent battery technology and competing emerging technologies such as liquefied petroleum gas/compressed natural gas (LPG/CNG)-powered CVs. This is due to their inability to support a wide range of commercial vehicle (CV) duty cycles, especially long-haul freight movement.

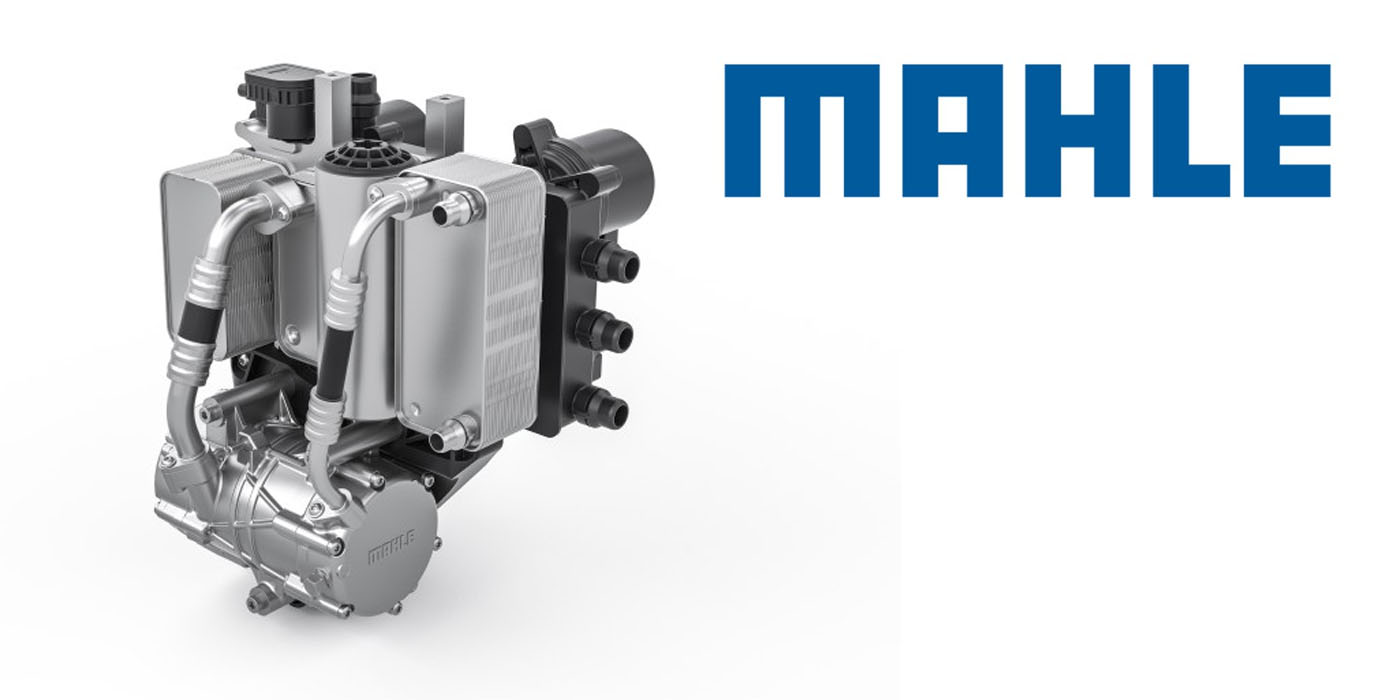

Thus, in order to stand out in the market and beat back the competition, OEMs are focusing on power electronics and batteries.

"Power electronics is emerging as a key focal point for OEMs, some of which are looking at vertically integrating this aspect of the hybrid/electric powertrain system," said Frost & Sullivan Industry Analyst Bharani Lakshminarasimhan. "This is underlining the need for virtual integration of suppliers with OEMs, as it will enable suppliers to assume the research and development responsibilities of OEMs."

In the future, both module and component suppliers’ margins will shrink as OEMs begin exerting pricing pressures with growing volumes. Duty cycle restriction of current hybrids indicate a need for concerted strategies aimed at developing vehicles and products that deliver the highest efficiencies in targeted vocations and duty cycles. OEMs have to develop duty cycle-focused product platforms while suppliers should work on virtual integration to ensure sustainable market growth and development.

On the back of these efforts by OEMs and suppliers, almost every major truck maker and bus manufacturer in North America has a hybrid model now.

"Of all alternative powertrain technologies, hybrid technology places the least pressure on existing infrastructure, which is why a multitude of OEMs are offering this technology in one or more model lines within the medium-heavy truck and bus markets," noted Lakshminarasimhan.

Both North and South American markets are evolving due to more customer pull than push, indicating a sustainable growth path. They are impelled to use hybrid/electric CVs due to energy price volatility, the need for energy independence and rising consumer demand for green technologies.

"Urbanization, rising congestion, and higher emissions are accelerating hybridization and electrification of powertrains," observed Lakshminarasimhan. "Regulatory environment, incentives, and tax credits are also paving the way for a larger parc of hybrid and electric CVs."

Strategic Analysis of the Medium- to Heavy-duty Hybrid and Electric Commercial Vehicle Market in North and South America is part of the Automotive & Transportation Growth Partnership Services program, which also includes research in the following markets: Commercial Vehicle Industry Subscription, North American Automotive Aftermarket Subscription, European Automotive Subscription and North American Advanced Automotive Technologies Subscription. All research services included in subscriptions provide detailed market opportunities and industry trends that have been evaluated following extensive interviews with market participants.