The e-commerce automotive aftermarket is expected to cross $30 billion USD by 2025, according to a new research report by Global Market Insights Inc. The global e-commerce automotive aftermarket is expected to generate a demand of more than 1 billion units till 2025. Increasing age of vehicles across the globe, specifically in developed countries coupled with shifting consumer preference towards online purchase of auto components will primarily drive the industry growth over the forecast timeframe. Changing style preferences of consumers and increasing customizations in vehicles will further strengthen the industry penetration.

Steering and suspension is anticipated to dominate the e-commerce automotive aftermarket share over the forecast timeframe. This can be credited to rising demand of components such as control arms, coil springs and bearings. Availability of numerous options at reasonable price and choice will positively impact the product demand.

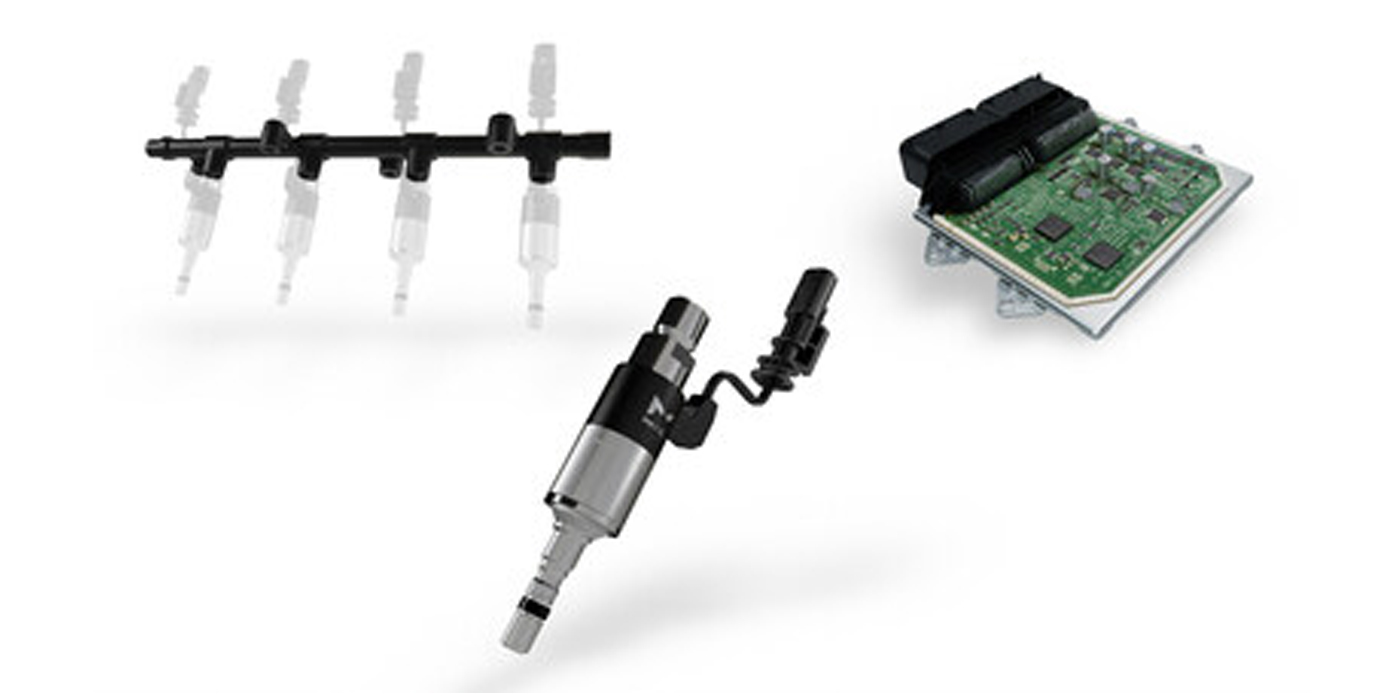

Spark plugs are expected to exhibit more than 21 percent CAGR till 2025 owing to recommendation of vehicle manufacturers for product replacement after every 30,000 miles. Increased accident rates along with cheaper product availability as compared to its counterparts will further propel the segment’s growth.

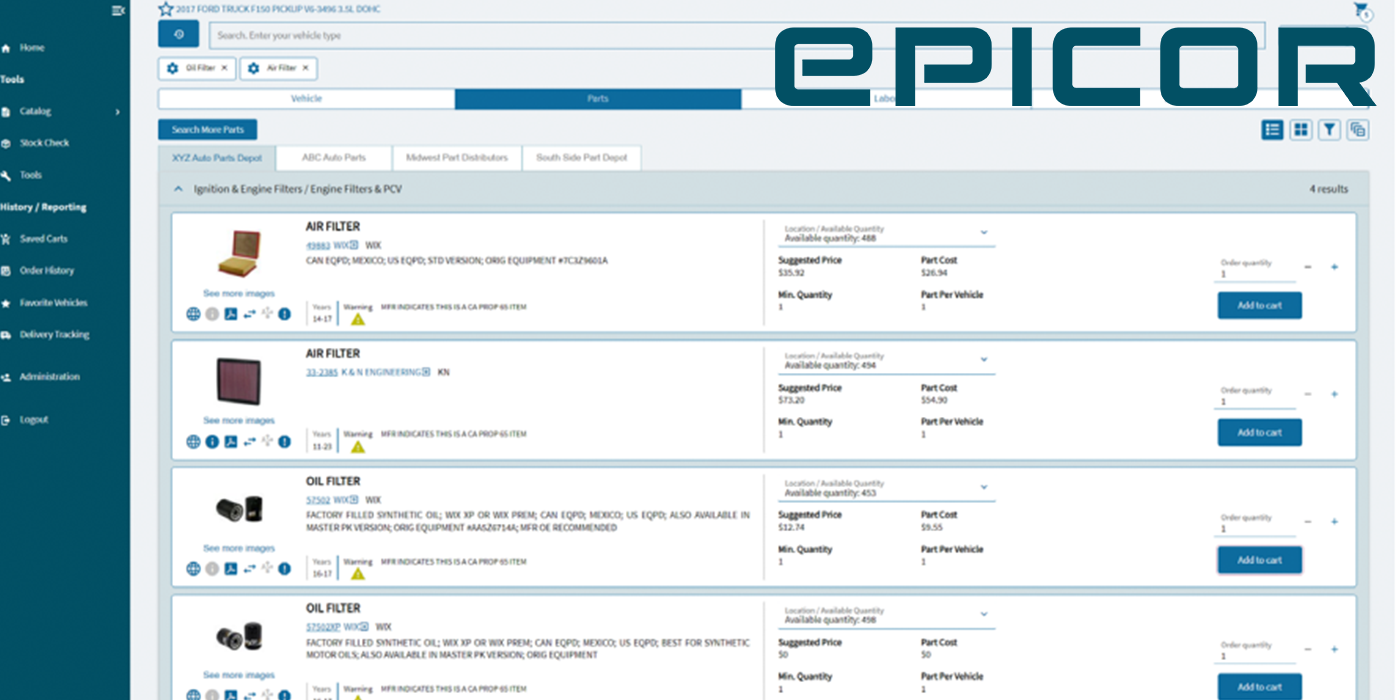

Online platforms have gained prominence among the automotive aftermarket industry players to launch their auto-parts portfolio. The manufacturers are increasingly launching their products on online platforms through third party retailers, such as Amazon and eBay, or via their own online portals, positively impacting the industry growth. However, lack of efficient standardization for e-commerce businesses may lead to easy counterfeiting of products, posing a threat to the industry growth over the forecast timeframe.

Rising production of electric and hybrid vehicles across the globe has resulted in increased complexity of the intricate parts. This has led to increased production of automotive aftermarket parts owing to proliferating DIFM customers. The e-commerce automotive aftermarket players are forced to expand their portfolio, to cater to the rising demand, inducing immense potential to the industry size till 2025.

Third party retailers are likely to account for highest revenue share crossing $29 billion USD by 2025. Rising popularity of these retailers such as eBay and Amazon will primarily drive the industry growth. High revenue generation also can be attributed to the distinct services. Moreover, provision of benefits such as same day delivery will further strengthen the e-commerce automotive aftermarket penetration.

Direct to customer will exhibit approximately 21 percent CAGR from 2018 to 2025. This can be attributed to high brand loyalty of the customers and provision of appropriate service facilities. The automotive aftermarket players such as Bosch are expanding their online platforms to enhance their visibility among the customers.

B2C will account for maximum revenue share crossing $13 billion USD over the forecast timeline. Shifting preference of customers towards online purchase of these auto parts will primarily support the industry dominance. This can be attributed to the cost effectiveness of the online portals as compared to conventional stores. Fast query solving, and provision of technologically advanced products will further escalate the revenue generation. B to big B will exhibit more than 19 percent CAGR owing to provision of benefits such as fast delivery services.

North America e-commerce automotive aftermarket size is anticipated to exhibit a CAGR of approximately 17 percent by 2025. Well-established internet infrastructure will pave stable growth prospects to the region’s growth. Presence of prominent e-commerce leaders such as Amazon will strengthen the industry growth over the coming years. Asia Pacific is likely to exhibit considerable share of more than $9 billion USD over the coming years. The substantial revenue generation can be attributed to growth in automobile industry along with rising internet penetration across the region.

Napa Auto Parts, DENSO Corp., Amazon, eBay, Auto Zone and Advance Auto Parts are among the prominent participants in e-commerce automotive aftermarket. Partnerships and collaborations with online aftermarket players are among the strategies adopted by the industry players to enhance their visibility. For instance, in 2016, Hella Group collaborated with online auto-parts supplier, iParts.pl in order to expand its product line.