While the automakers are making record profits, they’re also facing unprecedented financial challenges presented by new technologies, societal changes, government regulations and increased competition, all of which will require historic levels of capital investment to remain competitive. And, in spite of the current boom, many industry analysts expect auto sales to drop in 2018-‘19, which will reduce revenue.

These same analysts agree that if automakers are going to meet these financial challenges they will have to work more closely with their suppliers to be successful, because OEMs spend 70 to 80 percent of their revenue on parts, components and materials provided by their suppliers.

“Going forward, automakers will have to invest heavily in new resources and training programs to improve their working relations with suppliers because suppliers have a significant impact on an automaker’s profits,” said John Henke, president of Planning Perspectives Inc. “Currently, this investment isn’t happening across the OEMs with sufficient focus.”

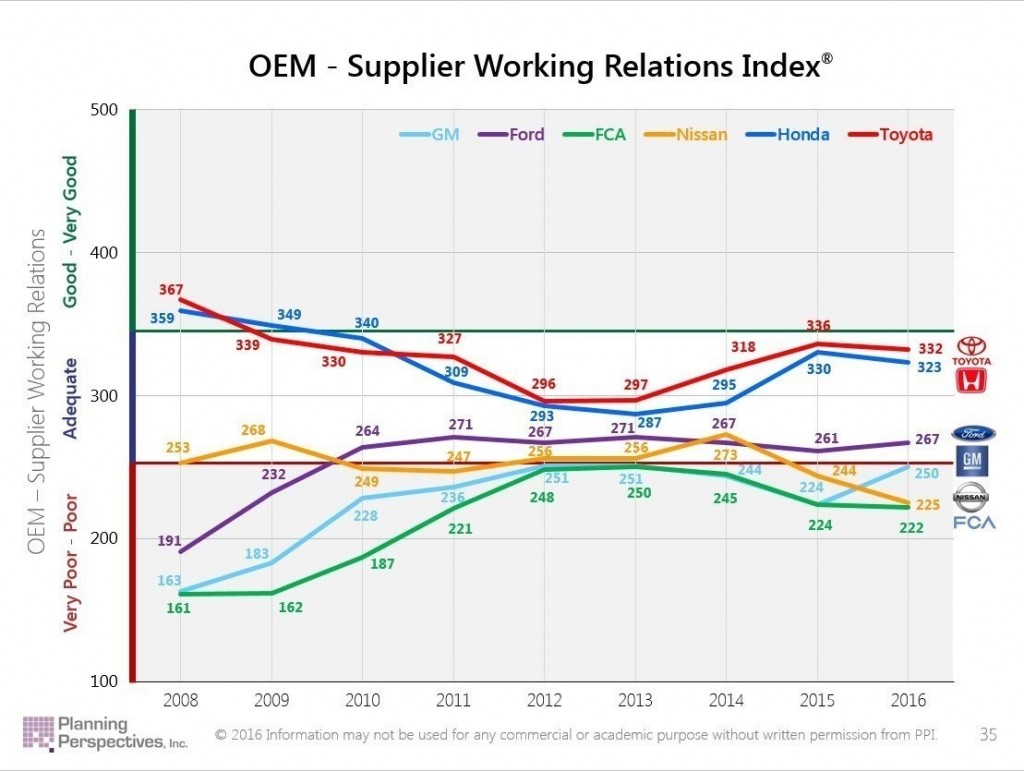

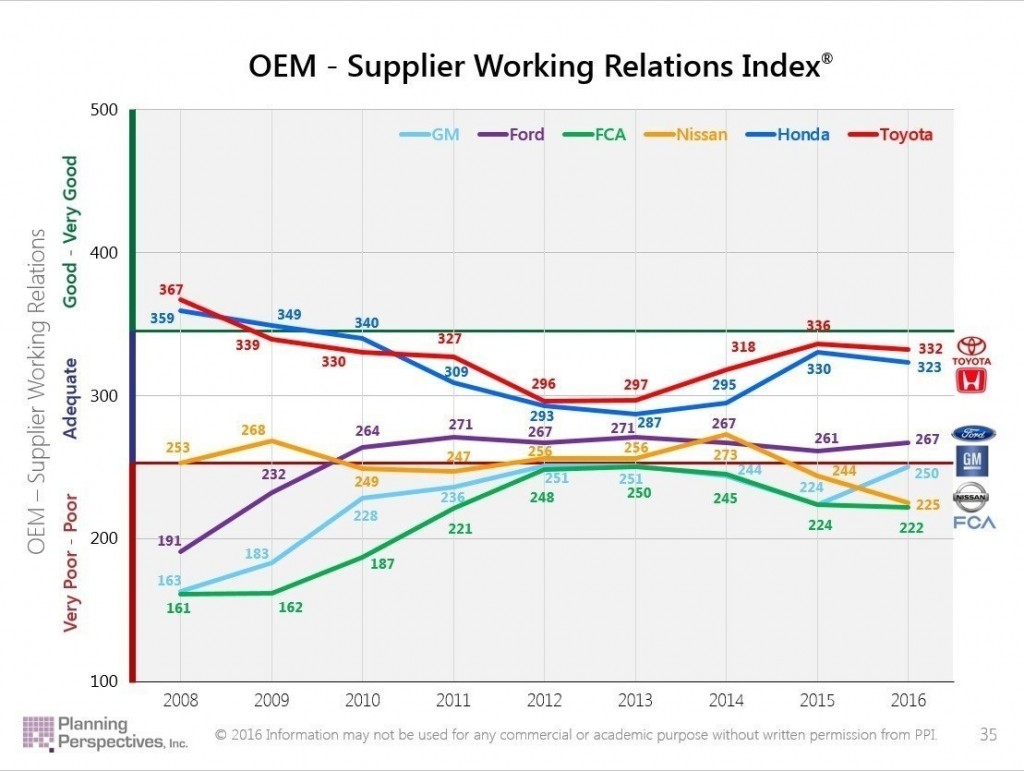

That’s the conclusion of Planning Perspectives’ 16th annual North American Automotive OEM – Supplier Working Relations Index Study which evaluates and ranks Ford, General Motors (GM), FCA US, Nissan, Toyota and Honda on their working relations with their suppliers.

The study shows that of these six automakers, only GM – a historical laggard – showed significant improvement in this year’s study gaining 26 points and moving up to fourth place in the rankings by displacing Nissan, which dropped 19 points to fifth. Nissan and FCA now significantly lag the other OEMs. Ford improved by six points, but continues to significantly lag the two traditional leaders – Toyota and Honda. Both of these Japanese automakers had shown significant improvement over the past two years, but this year dropped four and seven points, respectively.

“At a time of record profits when the automakers should be investing in building more collaborative relations with their suppliers, the major indicators of this year’s study suggest this isn’t happening,” said Henke. “We had expected Toyota and Honda to keep improving into the Good-Very Good WRI range, but their several years of improvement seem to have halted. Ford supplier relations have been stagnant since 2010, bouncing back and forth in the low Adequate range. Nissan relations have dropped significantly during the past two years to being just ahead of FCA, which has been in last place since 2008. The only bright spot this year is GM – they improved significantly – back to the low Adequate status where they were three years ago.”

The study is watched carefully in automakers’ boardrooms because an OEM’s supplier relations rating is highly correlated to the benefits that a supplier chooses to give an OEM – including which OEM is first to see a supplier’s newest technology, is provided a supplier’s best personnel for support, and gets their best pricing – all of which impacts an OEM’s competitiveness and the suppliers’ contribution to the OEMs’ operating profit, said Henke.

Key Indicators: Trending Flat To Negative

Key Indicators: Trending Flat To Negative

The annual study evaluates the relations between OEM buyers and their suppliers. Over the years, the study has shown that automakers must have certain relations-related characteristics in their purchasing organizations in order to build more collaborative relations which lead to greater profits. The problem as Henke sees it is that these key characteristics have been flat or declining for several years for nearly all of the automakers, including GM, in spite of its improvement this year.

Nissan and FCA are ranked in fifth and sixth place respectively on the WRI and are on trajectories that don’t bode well for either company, said Henke. For both, the percentage of buying situations the suppliers rank as being Very Poor – Poor (red bars) is increasing, while the percentage ranked Good – Very Good (green bars) is falling – and has been for several years.

At GM, while Very Poor – Poor buying situations are declining somewhat, Good – Very Good relations are flat, with improvement only in the Adequate range. At both Honda and Ford there’s a slight increase in the Very Poor – Poor ranking and a decline in the Good to Very Good. Toyota is essentially flat in both buying situation categories.

“Overall, relations at Nissan have been essentially flat since 2008, followed by the significant drop of the past two years, while Ford relations have been flat with very little improvement since 2010,” said Henke. “The flat Toyota and Honda relations this year are somewhat surprising given their steady improvement since 2013. We had expected both to continue improving into the Good – Very Good category where neither has been since 2009. These results suggest change is needed by all six automakers if future challenges are to be successfully met,” said Henke.

Purchasing Area Volatility

The lack of progress in improving supplier relations becomes more evident when the relations for each OEM are considered at the Purchasing Area level, the study shows. Even improvements at the traditional industry leaders in working relations – Toyota and Honda – are stagnating. This past year Toyota improved in three Purchasing Areas while dropping in three, and Honda dropped in five out of six. Ford and FCA improved somewhat in three Areas, but dropped in three others. Nissan dropped in all six areas. Only GM showed meaningful improvement in its Purchasing Area performance – five of six areas improved.

The range of difference between the highest and lowest rated Purchasing Areas in each OEM further suggests that disparate approaches are being taken by mid-level purchasing personnel within each OEM in building more collaborative supplier relations, said Henke.

OEMs Building Trust – Mixed Results

One of the most important measures of OEM-Supplier relations is trust, said Henke. As in any relationship, it is the foundation upon which everything else is built. Both the Purchasing VP and Buyers must be committed to this effort. However, when it comes to actively building more trusting supplier relations five of the OEMs show disappointing results.

The charts show that only the buyers at GM are considered by suppliers to have improved in working to build more trusting relations with them. Buyer rankings at FCA, Nissan and Ford have been declining in this area for the past several years, while the Purchasing VPs at GM and Ford show improvement this year.

More importantly, said Henke, only GM’s Purchasing VP and buyers appear to be working together to build trusting supplier relations. At FCA, and particularly at Ford, the Purchasing VPs are perceived by suppliers to be working to build more trusting relations but their Buyers are not. This suggests the mid-level Purchasing managers are not conveying those VPs’ expectations down to lower levels and the buyers. Even Toyota and Honda have to focus more on this activity if they are going to be prepared for the challenges of the future, he noted.

“The Purchasing Area volatility, coupled with these less than rigorous efforts to build more trusting supplier relations suggests the automakers’ purchasing executives may have taken their eye off the ball,” said Henke. “More needs to be done at every level by every Purchasing VP. For example, we know that investing in the training or retraining of buyers – who are key in building collaborative working relations – works; that’s how Toyota and Honda turned around their relations ranking in 2013.”

More Collaborative Relations – Greater Supplier Contribution To OEM profits

Henke says the automakers – and most companies – despite statements to the contrary continue to believe that beating up suppliers for price reductions leads to greater profits. But it’s not true, he says.

“Oftentimes, when companies are in financial trouble or want to improve their profits, they turn to squeezing suppliers for price reductions in the belief that this will help the company’s bottom line,” said Henke. “Our studies over the years have proven conclusively this is not only the wrong approach, it is an approach that destroys supplier relations. Strong, profitable industry-leading companies are those with the strongest, collaborative supplier relations. OEMs cannot simply focus on supplier price reductions if they expect to get the best from their suppliers.”

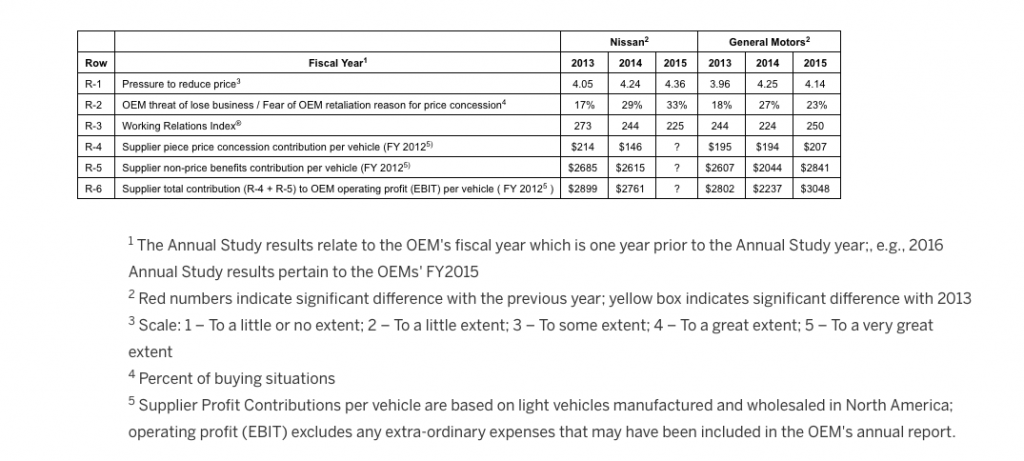

Data from this year’s study substantiates this claim (NOTE: the 2016 study reflects 2015 experiences).

The table below compares GM and Nissan, and shows that Nissan has been increasing pressure on suppliers to reduce prices (Row-1). While price reduction pressure itself does not impact supplier relations, said Henke, the pressure was accompanied with increasing threats to reduce business or retaliation if the concession was not given (Row-2) and now stands at 33 percent. At the same time, Nissan’s WRI dropped significantly from 2013 to 2015 (Row-3).

“These occurrences, plus other negative characteristics such as the Nissan VP and Buyers dropping significantly in their rankings, suggest that Nissan took a very aggressive adversarial approach to getting price concessions from suppliers,” said Henke. “However, things didn’t work out as planned. Nissan’s aggressive behavior caused supplier buying situations experiencing Very Poor – Poor relations to increase dramatically in 2014 and 2015. As relations worsened suppliers reduced their price concessions which resulted in a lower price concession contribution per vehicle in 2014” (Row-4).

“In addition, suppliers pulled back dramatically in providing Nissan non-price benefits that could help Nissan improve the efficiency and effectiveness of its operations. Our calculations indicate that the supplier non-price benefits contribution decreased in 2014 (Row-5). The net economic gain Nissan expected from aggressively pursuing price reductions from suppliers turned out be lower, not higher.” (NOTE: Nissan’s 2015 Annual Report will not be available until mid-May, hence supplier profit contributions for 2015 cannot be determined yet.)

The same thing happened to GM. In 2014, GM pursued supplier price reductions more aggressively, relative to 2013 (Row-1). While GM suppliers didn’t reduce their piece price contribution per vehicle in 2014 (Row-4), the suppliers’ non-price benefits contribution dropped substantially (Row-5). The net economic result for GM in 2014 had the same impact as Nissan experienced in 2014. Suppliers’ contribution to both OEM’s operating profit (EBIT) dropped.

However, the table shows that in 2015 GM significantly reduced its price reduction pressure on suppliers (Row-1). But while the pressure remained high, the percent of buying situations indicating that GM threated to reduce business or retaliate in some way also dropped (Row-2), while GM’s WRI improved significantly (Row-3). This suggests that in 2015, pressure was being applied on suppliers in a less aggressive, more collaborative manner than occurred in 2014, said Henke.

The net economic result for GM in 2015 was an increase in price concession contributions and non-price benefits contributions from suppliers.

“These positive results track our research, which has conclusively proven that the more collaborative a company’s supplier relations are, the more suppliers will contribute to its profits,” said Henke. “With the significant demands facing the industry, no automaker can afford to marginalize its supplier relations. Every OEM must begin working today to ensure it will have significantly improved collaborative relations in the next several years.”